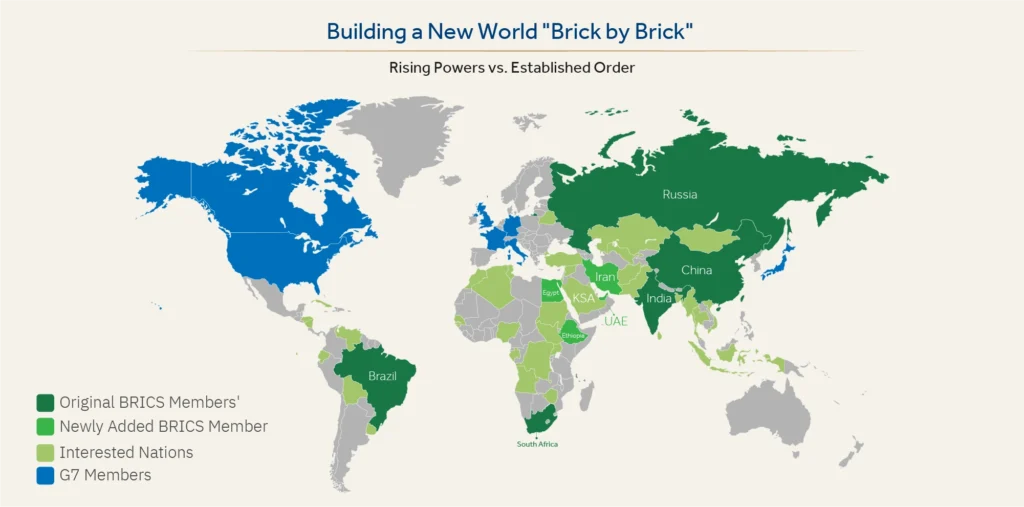

On October 22nd, Russia will host the BRICS+ annual summit—its ranks swelled by new members and ambitions. As this year’s chair, Russia presides over a bloc that now represents 45.5% of the world’s population—more than four times that of the G7—with a combined GDP of $28.5tn, and 25% of global exports.

BRICS+ is poised to expand even further, with no fewer than 40 countries expressing interest in joining the bloc as of 2024. While the West frets over a potential challenge to its dominance, the reality is more nuanced. BRICS+ is less an anti-Western monolith than a reflection of the Global South’s desire for a multipolar world—one where it has a greater say in shaping global norms.

Within the BRICS+, however, internal tensions abound from its fundamental diversity, the varying political systems of its members, and their sometimes competing economic priorities. For instance, while China, Russia, South Africa and Iran are pursuing geopolitical competition to challenge Western institutional hegemony, other BRICS members like Brazil, India, (Saudi Arabia, if it ultimately joins) and the United Arab Emirates hope the grouping will help diversify their relations while not drastically diverging from their longstanding alignment with the West.

Still, even those members in the Global South close to the West feel alienated by recent Western policies like the support for Israel’s genocidal campaign in Gaza and its war in Lebanon. As their own influence as middle powers increasingly allows them to shape the international agenda, the allure of constraining Western hegemony may prove a potent unifying force for BRICS+, despite member differences. The question is not whether BRICS+ is inherently an anti-Western bloc, but whether the West’s own actions will push it to become so.

The Rise of BRICS+: A Multipolar World in the Making

Despite some early skepticism, the BRICS grouping has defied low expectations and become a significant force in global affairs. The bloc’s expanding agenda, encompassing issues from trade disputes and regional stability to fostering diplomatic ties, underscores its growing ambition to play a more substantial role in global governance.

At the 2023 summit in Johannesburg, the BRICS list of commitments stood at 94, up from 16 at its first summit in 2009. To further strengthen its cohesiveness and influence, BRICS+ is facilitating the exchange of ideas and expertise among policymakers, researchers, and academics across its member states. This multi-level dialogue is coupled with high-level ministerial meetings regularly convened across a range of crucial sectors, including defense, health and climate change.

Not So Lonely After All

The BRICS+ group also serves as a diplomatic safeguard and counterweight to Western pressure on its members. A prime example is Russian President Vladimir Putin’s strategic use of BRICS. Following the annexation of Crimea in 2014 and the invasion of Ukraine in 2022, Putin leveraged the BRICS platform to deflect criticism and demonstrate continued international support for Russia. BRICS provided Putin with a stage to show that Russia was far from being the “pariah state” the West was depicting it to be.

Even as the EU imposed sanctions on Russian oil exports in 2022, BRICS members challenged Western attempts to isolate Russia by demonstrating their commitment to maintain strong diplomatic and economic ties with Moscow. With China and India absorbing most of Russia’s crude oil exports, Brazil emerged as a key importer of refined products, primarily diesel and fuel oil. Brazil’s imports of Russian diesel surged by 4,600% in 2023, with fuel oil purchases increasing by 400%.

BRICS’ Economic Seeds of Change

A key point of contention for BRICS is the inequitable voting structure within the International Monetary Fund (IMF), where the imbalance is stark. Despite representing 25% of global GDP, BRICS+ countries hold only 18.4% of the voting power, compared to 19.1% for the combined voting power of Germany, France, the UK, Italy and Spain. This limits BRICS’s influence over key decisions. The disparity is further illustrated by China, which, despite being the world’s second-largest economy, holds a mere 6.4% of the voting power in the IMF. Proportionally, this pales in comparison to the combined 4.7% held by the Benelux countries—Belgium, the Netherlands and Luxembourg—highlighting the substantial imbalance in how voting power is distributed within this critical institution.

Frustrated by the slow pace of reform within existing institutions, the BRICS+ bloc is forging its own path. To reduce reliance on the IMF, BRICS has established the Contingent Reserve Arrangement (CRA). This mechanism provides member countries with a financial safety net to address short-term balance of payments difficulties. A common currency is also under development; and initial, albeit modest, steps to reduce reliance on the dollar have already been taken. A major milestone in this effort is the agreement among BRICS+ countries to increase the use of their currencies in trade, potentially paving the way for greater use of alternative financial systems like China’s Cross-Border Interbank Payment System (CIPS)—the Chinese alternative to the U.S.-dominated SWIFT system.

This agreement represents a step towards challenging the dominance of the U.S. dollar in international trade. However, realizing this goal will require sustained effort and further steps to establish robust alternatives to existing Western-dominated systems.

Additionally, BRICS established the New Development Bank (NDB) in 2015. In contrast to the World Bank and the IMF, which are traditionally led by Americans and Europeans, respectively, the Shanghai-based NDB features a rotating presidency and vice-presidency among its founding members.

Capitalized at $50bn, the NDB focuses on mobilizing resources for infrastructure and sustainable development projects in emerging economies. The NDB’s contributions, while currently modest in comparison to the World Bank’s $91bn disbursement in 2023, are steadily growing. Since 2019, the NDB has approved $32.8bn in financing for 96 projects across its five founding members, including loans denominated in currencies other than the dollar. The NDB is gradually expanding its reach and influence. The Bank welcomed Bangladesh, Egypt and the United Arab Emirates as new members in 2021. Uruguay remains a “prospective member” and Algeria was approved for membership in 2024. However, the NDB’s decision to halt new projects in Russia to preserve its operations and reputation, highlights the limitations it faces in challenging the prevailing Western-dominated financial order.

In sum, it is true that economic and political divergences exist between the BRICS+, but their shared frustration with the West’s actions and the allure of a more balanced global order could, nonetheless, outweigh these differences and constitute a unifying force. Moreover, how the West responds to the rise of the BRICS+ on the global stage will undoubtedly play a crucial role in shaping the trajectory of this evolving bloc.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of the Middle East Council on Global Affairs.