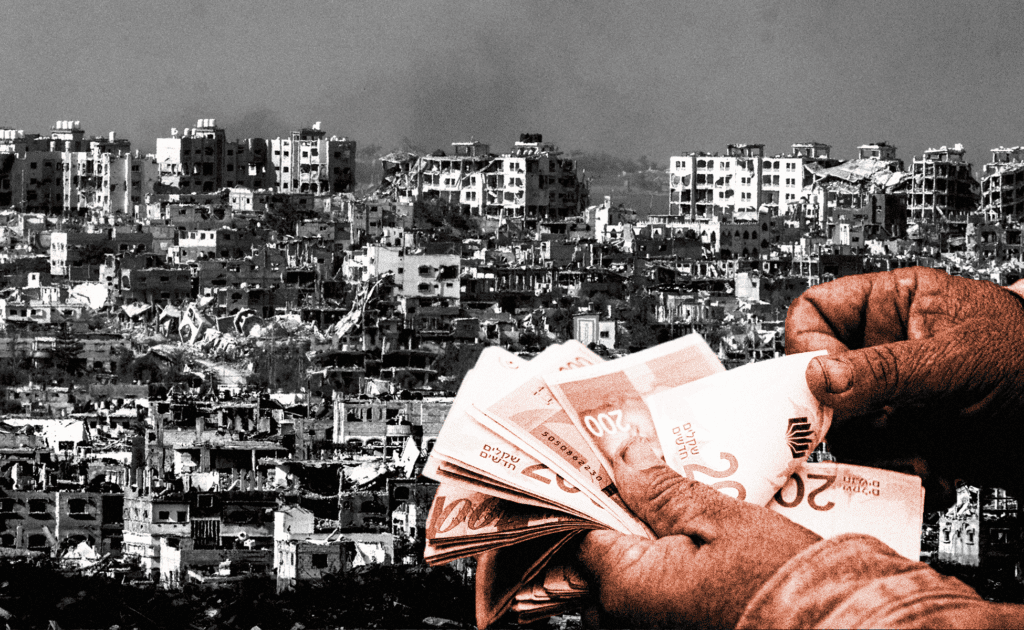

In early December, the Palestinian banking sector narrowly avoided financial freefall, as Israel’s far-right finance minister toyed with removing a crucial safeguard underpinning the correspondent relationship between Palestinian and Israeli banks. These safeguards protect the Israeli side from domestic and international legal risks arising from transactions with their Palestinian counterparts, offering immunity and indemnity if they are sued on charges related to financing terrorism or money laundering. Without them, Israeli banks would likely sever ties altogether. Yet because the Palestinian economy is denied its own monetary system and relies on Israel’s currency, the shekel, as the primary medium of exchange, severing the link between these banks would push the Palestinian side into disintegration.

Ultimately, Israel extended the safeguards by another year following an unprecedented campaign of diplomatic pressure led by the United States Treasury, G7 foreign ministers, and other international actors. Although the extension offers a brief respite, however, the Palestinian Authority’s stability is increasingly precarious. While Israel has long used economic levers to exert political pressure on the PA, the recent banking crisis augurs something far more profound in its implications.

The original decision by Israeli Finance Minister Bezalel Smotrich to pull the safeguards aligns with his broader vision of redefining Palestinian governance in the West Bank beyond the PA, including a reimagining of financial and monetary governance structures. The banking sector, once considered a rare pillar of stability in the occupied Palestinian territories, now faces unprecedented strains due to Israel’s repeated threats to terminate correspondent relations, a complex web of other Israeli-imposed measures, and a challenging macroeconomic and political environment due to Israel’s war on Gaza. Despite reassurances from the Palestinian Monetary Authority (PMA) and the World Bank that the sector is robust, mounting pressures suggest that a financial crisis may be imminent.

The State of the Sector

Operating under the supervision of the PMA, which is the PA’s equivalent of a central bank, the Palestinian banking sector comprises 13 banks managing combined assets of approximately $23 billion, including around $17 billion in deposits. Before recent challenges, Palestinian banks were among the most profitable financial institutions in the region. However, this success has not translated into sustainable economic growth. A significant portion of bank lending focuses on consumption and residential investments, inflating property prices in the West Bank and Gaza beyond those in neighboring countries. Substantial capital remains locked up in nonproductive assets, creating a skewed economy where banks profit while the population faces an increasing debt burden.

By Q4 of 2023, the banks had extended $12 billion in domestic credit facilities, 25% of which was associated with the PA or its employees. In Gaza, residents and businesses have approximately $931 million in outstanding credit, primarily directed toward the residential, real estate and construction sectors, constituting about 10% of all private-sector credit issued by Palestinian banks. Given the extensive destruction in Gaza, where more than 80% of commercial establishments and 87% of residential properties have been either significantly damaged or entirely destroyed, a substantial share of the collateral underpinning these loans has likely been rendered nonviable.

In the West Bank—which is considerably more leveraged than the Gaza Strip, with 90% of all outstanding Palestinian loans held by West Bank residents—Israeli military operations in the northern governorates have inflicted significant economic losses on public and private property, including homes, businesses and infrastructure. Although this has not yet precipitated a formal financial crisis, the potential for widespread default, intensified by a non-performing loan rate already at 4%, poses a significant threat.

Forcing a Crisis

Compounding these challenges, Israel has recently ratcheted up financial pressures on the PA and the banking sector. One key issue is that Israeli banks are increasingly refusing to process shekel clearance requests from Palestinian banks. Clearance is the process through which excess physical currency in the Palestinian banking system is transferred to Israeli banks. This mechanism is essential since the shekel must ultimately be cleared by the Bank of Israel, the issuing monetary authority, and is therefore critical for maintaining liquidity and the smooth functioning of financial transactions.

Since 1967, the shekel has functioned as the de facto currency in the West Bank and Gaza, but in recent years Israeli banks have increasingly declined to accept physical shekels from Palestinian banks. Simultaneously, the Bank of Israel has intermittently declined to process requests for shekel clearance initiated by the PMA. Furthermore, Israel has not increased the annual clearance limit, set at 18 billion Israeli Shekels (ILS), despite Palestinian banks requiring at least ILS 22 billion annually.

This has resulted in a surplus of shekels at Palestinian banks, pushing storage costs higher as vaults approach capacity. In response, banks have imposed restrictions on cash deposits in shekels and reduced interest rates on shekel loans relative to those in other currencies, such as U.S. dollars or Jordanian dinars. However, these measures remain provisional, leaving both traders and banks uncertain about how to address the escalating shekel surplus.

The financial sector in Gaza faces a far grimmer reality. Since October 2023, Israel has halted cash transfers to Gaza and destroyed nearly all of its banking infrastructure. As a result, Gaza’s banks have effectively exhausted their cash reserves. The widespread use of worn-out shekel notes further exacerbates concerns about the future of currency circulation, as Israeli banks are likely to reject such damaged notes. Palestinian banks cannot afford the financial losses associated with hundreds of millions of shekels in unusable currency, and neither the PMA nor the PA possesses the fiscal capacity to address this shortfall.

Economic Life Support

As the banking sector teeters, the broader macroeconomic landscape is no less dire. Israel’s genocidal war has reportedly slashed Gaza’s economic output by 81% and the West Bank’s by 19%. The Human Development Index has regressed by 69 years in Gaza and 16 years in the West Bank. Meanwhile, the Palestinian Authority remains on economic life support, reliant on sparse, conditional European aid. A recently reported agreement between the U.S. and Israel, under which Israel would release withheld Palestinian trade taxes (commonly known as clearance revenues), may temporarily bolster the PA’s ability to cover some recurrent expenditures. Yet the PA still shoulders $4 billion in debt to banks and owes an additional $4 billion in arrears to employees and suppliers, mostly accrued over the past two years.

A collapse of the Palestinian banking sector would have far-reaching repercussions. For Palestinians, it would dismantle the last vestiges of economic stability, exacerbate an unemployment rate close to 50% and fuel spiraling poverty, which the UN has forecast will hit 74.3% in 2024. The fallout would also impact Israel, whose economy derives substantial gains from trade with the Palestinian territories, with bilateral exchanges exceeding $800 million a month. In the event of a banking crisis or suspended banking relations, banks would be unable to finance trade operations or settle payments for goods and services sourced from Israeli firms and suppliers, including international imports channeled through Israeli intermediaries.

The Palestinian Authority has few effective instruments to reinforce or stabilize its banking sector. Short-term measures, such as extending correspondent relations with Israeli banks, devising currency management mechanisms with the Bank of Israel, or patching up Gaza’s devastated cash supply, may momentarily relieve pressure, but they cannot resolve the core problems. Voicing confidence in the banking system’s resilience while the Israeli military obliterates collateral and severs financial arteries merely obscures the full extent of the devastation.

Like everything in Palestine, the fate of the banking sector is intrinsically political. The PA’s decision to establish and nurture banking infrastructure under occupation proved naively optimistic, underestimating Israel’s relentless expansion and its own overreliance on international life support. Preserving Palestinian deposits and maintaining a functional financial system demands not only extraordinary political will but a radical reimagining of economic relations under Israeli domination. This fundamental shift is absent from the PA’s calculations. Without it, short-term fixes will falter and the sector’s vulnerabilities will persist.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of the Middle East Council on Global Affairs.