China in the Maghreb:

Forging a New Era of Geopolitical Influence

Issue Brief, October 2025

China’s Expanding Footprint in the Maghreb: China continues to expand its economic partnerships with Algeria, Libya, Morocco, and Tunisia, leveraging infrastructure projects, growing trade, targeted investments, and the Belt and Road Initiative. This is strengthening Beijing’s foothold in North African markets and positioning it as a key economic player in the Mediterranean, Africa, and Europe.

Beijing has Avoided Entanglement in Regional Disputes: China’s strategic neutrality on contentious issues, particularly the lingering Western Sahara dispute, has enabled it to maintain good relations with rivals Morocco and Algeria. This has bolstered China’s soft power and avoided entangling it in local geopolitical rivalries.

Algeria is China’s Maghreb Anchor: Algeria stands out as one of China’s most pivotal partners in the Maghreb due to deep historical ties, significant infrastructure cooperation, and growing security collaboration. Their Comprehensive Strategic Partnership, the first among the Arab countries, highlights Algeria’s central role in China’s broader regional strategy.

China Offers the Maghreb Alternative Options: China’s engagement allows the Maghreb states to diversify their international partnerships beyond the West. This gives them leverage and encourages a more diverse foreign policy approach as they seek to balance Western powers, China, Russia, and other major players.

Introduction

China’s strategic engagement in the Maghreb exemplifies its broader pursuit of a multipolar order regionally and internationally. By steadily deepening its presence, China aims to shape the economic trajectories and diplomatic alignments of regional states, as part of its overarching goals of securing resources, diversifying trade routes, and establishing influence. Despite their impressive momentum, China-Maghreb relations face significant obstacles, stemming from internal fragility in and among Maghreb states (conflicts, instability, weak institutions, and economic constraints), the involvement of China’s rivals (the European Union, United States, and regional actors), and the lack of balanced trade and cultural influence. China’s reduced lending capacity in the Maghreb also reflects a strategic adjustment and a shift in its appetite for risk.1

China’s pragmatic focus on infrastructure, its non-interference and non-alignment principles, and reliance on soft power has secured it durable partnerships in the Maghreb. As the region’s strategic importance rises, this issue brief examines Beijing’s ties with Algeria, Libya, Morocco, and Tunisia through its resource security strategy and push for a multipolar global order.

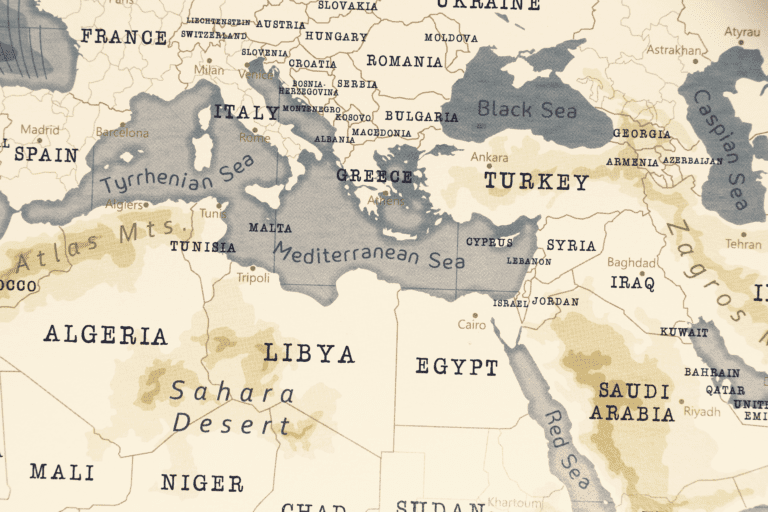

China’s approach in the Maghreb2 combines economic engagement and soft power projection. These countries, though diverse in political orientation, foreign relations, and economic structure, share a strategic location that bridges Africa, Europe, and the Middle East, making the Maghreb a key area for China’s broader global ambitions. China’s engagement with the Maghreb can be traced back to the mid-20th century, coinciding with decolonization efforts across Africa.

China’s support for anti-colonial movements significantly influenced its early diplomatic relations—especially with Algeria, whose struggle for independence from France mirrored Beijing’s revolutionary ideals. China recognized Algeria’s provisional government in 1958 and established formal diplomatic relations upon the country’s independence in 1962, which grew robustly thereafter. Morocco and Tunisia, independent since 1956, established ties with China in 1958 and 1964 respectively, followed by Libya in 1978. While initially symbolic, these relations deepened after China’s economic reforms in the late 1970s. China’s neutrality on the Western Sahara dispute enabled it to maintain balanced ties with both Morocco and Algeria.3

China’s outreach to Africa, and to the Maghreb in particular, has long been characterized by a pragmatic mix of economic diplomacy, infrastructure investment, and political engagement. In Sino-Maghreb relations, China has defined its own role and shaped those of its partners through both bilateral and multilateral mechanisms, with an emphasis on non-interference. China’s self-identification as anti-colonialist and anti-hegemonic aligns with the anti-colonial histories of the Maghreb, which helps further strengthen ties between both.

For China, Algeria is key for energy, infrastructure, and defense ties; Morocco hosts broad investments and connectivity projects; and Tunisia serves as a soft power platform. In Libya, China’s role has been limited since the instability that followed the 2011 overthrow of Muammar Gaddafi’s regime, highlighting Beijing’s preference for avoiding entanglement in conflict.4 Across the Maghreb, China has expanded its role in infrastructure via loans, construction, and technology transfers.

China’s economic engagement with the Maghreb particularly accelerated following the launch of the Belt and Road Initiative (BRI) in 2013. By 2024, trade reached $31.5 billion, primarily with Algeria. Its investments and contracts from 2020-2024 were worth $8.56 billion, with Algeria receiving the lion’s share, worth $6.04 billion.5 All four Maghreb states have joined the BRI and the Asian Infrastructure Investment Bank, and all have strategic partnerships with China.

Source: UN Comtrade, “Trade Data.” 6

China’s Bilateral Relations with Maghreb States

Despite this engagement, China has no integrated approach to the Maghreb as a bloc. This section therefore discusses China’s relations with individual Maghreb states.

Algeria: China’s Key Partner

Algeria remains one of China’s most significant partners in the Maghreb. Their long-standing relationship, rooted in shared anti-colonial histories, has evolved into a comprehensive strategic partnership. Algeria’s pivotal role is reinforced by its energy wealth, strategic location, and political stability, making it vital for China’s North African and West Asian ambitions. Although China does not always take Algeria’s position on its core interests, notably the Western Sahara, their political relations remain solid.

In 1971, Algeria rallied African nations to recognize the People’s Republic of China as the country’s only legitimate representative at the UN, ousting the Taiwan-based Republic of China from China’s seat.7 Algiers then played a key role in deepening China-Africa relations, collaborating closely with Beijing to aid liberation struggles across Africa, including by facilitating Chinese arms transfers to liberation groups.8

Sino-Algerian relations progressed significantly with the establishment of a Strategic Partnership in 2004, which was elevated a decade later into a Comprehensive Strategic Partnership.9 Algeria was the first country in the Middle East and North Africa (MENA) region to establish this partnership with China.10 In 2022, the two countries signed their second five-year comprehensive strategic cooperation plan that spans 2022-2026.11 Algeria–China cooperation encompasses trade, energy, agriculture, and technology, and supporting economic diversification and modernization efforts. It includes joint research in science, space, and health, along with cultural and educational exchanges—highlighting the depth and breadth of this partnership.

President Abdelmadjid Tebboune’s July 2023 visit to China underlined these growing relations. Tebboune expressed Algeria’s support for President Xi Jinping’s three flagship initiatives: The Global Security Initiative (GSI), the Global Development Initiative (GDI), and the Global Civilization Initiative (GCI).12 China and Russia also backed Algeria’s 2022 bid to join the BRICS; however, Algeria is yet to receive a formal invitation to join the bloc.13 In May 2024, Algeria officially applied to become a dialogue partner of the Shanghai Cooperation Organization (SCO), signaling its interest in deeper engagement with Eurasian political and security frameworks.

During Tebboune’s visit, Algiers and Beijing signed 19 agreements and Memoranda of Understanding (MoUs) covering various aspects of bilateral cooperation. China pledged over $36 billion-worth of investment in Algeria, with a focus on manufacturing, technology, transport, and agriculture.14 Since 2013, China has overtaken France as Algeria’s top commercial partner, with bilateral trade reaching nearly $12.5 billion in 2024.15

Chinese firms play a key role in Algerian infrastructure and connectivity, notably building roughly half of the 1,200-kilometer (750-mile) East-West Highway, as well as involvement in a further expansion of the country’s road network.16 China is also supporting the construction of another large-scale railway in Algeria. Funded by Algeria’s national budget with over $3.2 billion and supported by external loans (including $3 billion from the Islamic Development Bank).17 The 575-kilometer line will connect the Gara Djebilet iron ore deposit near Tindouf, one of the largest in the world, to the southwestern city of Béchar, for processing and export.18 Awarded to China Railway Construction Corporation (CRCC) and the Algerian state firm COSIDER, the project is set to be completed by the end of 2026, significantly boosting Algeria’s steel industry. 19

China has also actively invested in the country’s energy infrastructure, including nuclear reactors to aid Algeria’s diversification efforts. In June 2025, Chinese firms ZPEC Group and Sinopec won hydrocarbon exploration licenses, boosting China’s strategic drive for energy security. 20

In 2022, Algeria passed a new investment law aimed at attracting foreign capital through incentives and clearer regulations. This encouraged Chinese investments in major projects such as the $7 billion Bled El Hadba Phosphate Megaproject, launched in 2024 with Chinese firms Wuhuan and Tian’an. Focused on mining and fertilizer production, it aims to create over 12,000 jobs and expand Algeria’s industrial capacity. 21 Algeria and China have also increased cooperation within the automobile sector. Notable examples include a $105-million Jetour Automotive Plant in Batna, a joint venture between Algeria’s FONDAL and China’s Jetour that is nearing completion. The venture aims to produce 270,000 vehicles over five years, creating some 1,000 jobs.22

On top of these projects, in April–May 2025 over a dozen agreements aimed to strengthen cooperation in energy, manufacturing, agriculture, and infrastructure were signed. Eight additional deals were struck at the Algerian-Chinese Business Forum, in April 2025, focusing on industrial and agricultural investments.23

Sino-Algerian cooperation on solar energy has also accelerated over the past five years, with large-scale photovoltaic (PV) deployments, strategic partnerships, and technological integration. Central to this effort is Algeria’s 2-GW auction, which included 15 solar PV projects, launched by Sonelgaz in 2023. China was awarded nine of the fifteen projects.24 A Chinese consortium secured contracts for five of the nine solar plants totaling 780 MW, while other Chinese firms including the Shanxi Installation Group, PowerChina Zhongnan, and PowerChina also won major projects.25 This is set to boost Algeria’s solar capacity nearly seven-fold to over 3,400 MW, diversifying its energy sources, boosting the economy, and highlighting China’s key role in Algeria’s transition efforts.

Security ties have also deepened. Over the past decade, and particularly since 2020, China has emerged as an important arms supplier to Algeria, although Russia remains its main supplier by far.26 These arms deals reflect Algeria’s strategic diversification efforts and China’s expanding security footprint in North Africa which has raised alarm in key Western powers, notably the United States and France, concerned about the shifting balance of power in the Maghreb and their place in Algerian arms markets. 27 China and Algeria’s growing military ties therefore impact broader regional security dynamics and intra-Maghreb dynamics.

The United States considers China’s arms transfers to Africa as part of a broader strategy to enhance its geopolitical influence through military diplomacy while France views Algeria’s increasing reliance on Chinese systems as signaling a decline in its own traditional military influence in North Africa. There is also growing concern about the potential for technology transfers and joint production initiatives between China and Algeria that would enhance the latter’s domestic defense industry. 28 China’s flexible, affordable arms sales, free of strict end-use conditions, typical of its Western competitors, challenge the influence of traditional actors in North Africa. Algeria, with an independent foreign policy, is unlikely to shift course—especially amid regional tensions including the Iran-Israel tensions, and Tel Aviv’s growing ties with Morocco.

Algeria has imported advanced Chinese arms including Wing Loong II and WJ-700 drones and SY-400 missile systems, as well as collaborating on building Type 056 corvettes.29 China also supplies advanced HQ-9 surface-to-air systems and radar technology like the JY-11B air surveillance system, bolstering Algeria’s air defenses.30 Algiers thus increasingly sees Beijing as a reliable partner to help diversify its arms suppliers, through joint training and licensed production of weapons, as well as a broader security partnership with high-level exchanges, joint exercises, and arms deals. Chinese-supplied capabilities enhance Algeria’s role in Sahel security and counterterrorism. For its part, Beijing views Algeria as a strategic gateway to Europe and Africa, supporting its regional ambitions.

Morocco: Diversification and Connectivity

China has also strengthened its political and economic ties with Morocco, especially since the kingdom joined the BRI. Rabat-Beijing ties remain primarily economic and diplomatic, with limited—albeit gradually growing—military cooperation. Politically, Sino-Moroccan relations have steadily strengthened, underpinned by increasing high-level exchanges. They reached a pivotal milestone in 2016, when King Mohammed VI and President Xi Jinping signed a Strategic Partnership Agreement, underscoring their shared commitment to advance both states’ cooperation in economic development, culture, and regional security.

While Morocco is increasingly strengthening ties with China, it is balancing between its traditional Western allies (notably the United States and France) and emerging powers. Rabat supports Beijing’s “One China Policy,” refraining from establishing formal ties with Taiwan, and has shown understanding of China’s stance on issues including Hong Kong and Xinjiang.31 For its part, China has maintained a policy of neutrality on contentious issues involving Morocco, namely the Western Sahara.32 Beijing does not explicitly support Morocco’s claims to sovereignty over the region, but has also refrained from recognizing the Polisario Front or the Sahrawi Arab Democratic Republic.33 China values Morocco’s strategic location and ties to the Gulf, sub-Saharan Africa, and the EU. Morocco and the EU share a free trade agreement, and Morocco is designated a major non-NATO ally by the United States, which in 2020 recognized Morocco’s claim over the Western Sahara, breaking with decades of U.S. policy on the issue.

Economic cooperation however forms the bedrock of Sino-Moroccan relations. The signing of the MoU on the BRI in 2017 was a turning point, enabling large-scale Chinese investments in Moroccan infrastructure, logistics, and renewable energy. One flagship project is the Mohammed VI Tangier Tech City, an industrial and technological hub developed by a number of Chinese companies. After several delays and negotiations, construction officially resumed in 2023 with an anticipated wider Chinese role in the automotive and aerospace sectors.34

Trade between the two countries has grown significantly. Bilateral trade has doubled since 2019 35, reaching $9 billion in 2024.36 In the first half of 2025, Moroccan exports to China added up to $350.39 million.37 Morocco’s exports primarily include raw materials and phosphates, while its imports from China are dominated by electronics, machinery, and manufactured goods.

China’s involvement in Moroccan infrastructure includes securing multimillion-dollar contracts to expand the high-speed rail from Kénitra to Agadir.38 In addition to infrastructure, Chinese firms are involved in the automotive and energy sectors, particularly renewables.

Sino-Moroccan military and security cooperation is limited, but growing. Morocco is gradually diversifying its procurement, notably purchasing China’s Wing Loong II drones.39 The procurement of Chinese military technology is part of aims to reduce dependency on Western military equipment, and partners, and foster a more independent and versatile defense infrastructure. The Moroccan Royal Armed Forces have integrated several Chinese defense systems into their military arsenal, reflecting both a strategic shift towards China as a trusted supplier of advanced military technology, and a deepening of their overall bilateral military relations.

Overall, this evolving relationship aligns with Morocco’s broader geopolitical strategy of balancing its defense alliances and cultivating partnerships with emerging global powers, thereby enhancing its strategic autonomy and national security capabilities. However, Chinese arms serve a complementary, rather than primary, role in Morocco’s defense strategy.

Tunisia: Emerging Relations with Caution

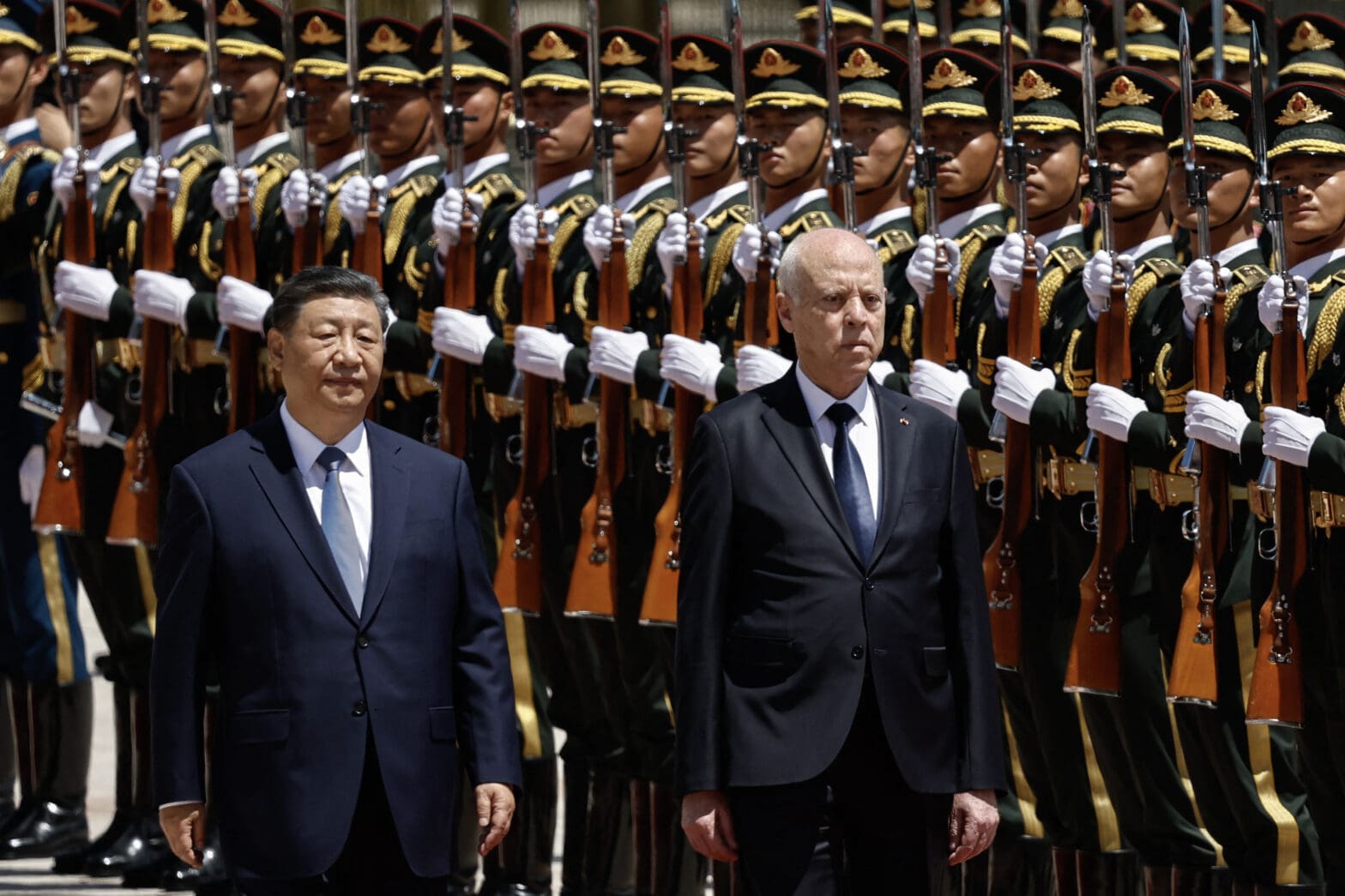

China and Tunisia have strengthened their relations in recent years, culminating in a Strategic Partnership signed during Tunisian President Kais Saied’s May 2024 visit to Beijing and participation in the 10th China–Arab States Cooperation Forum. In adherence to its non-interference policy, China sustains diplomatic engagement with Tunisia irrespective of internal politics shifts and unpopular domestic policies, like the EU countries.40

From 2022-2024, China-Tunisia trade grew from $2.1 billion annually to about $2.88 billion, with Chinese exports at $2.38 billion and Tunisian exports at $500 million.41 Despite this increase, Chinese direct investment in Tunisia remains modest. However, several BRI infrastructure projects are underway, including the International Diplomatic Academy and a university hospital in the coastal city of Sfax.42 Plans for deep-water ports and solar energy projects are also in progress.43

In the digital sector, Huawei and other Chinese companies have supported Tunisia’s ICT development through cloud computing initiatives. Discussions on 5G networks and Beidou satellite services have taken place; but, progress remains limited, partially due to Tunisia’s preference for European technologies in a number of areas.44

Sino-Tunisian bilateral cooperation extends to trade, agriculture, infrastructure, and digital economy initiatives. Tunisia has also sought to position itself as a regional export platform into both Africa and the EU, participating in the June 2025 China–Africa Economic and Trade Expo in Changsha, where it reaffirmed its commitment to deeper trade cooperation.45 Despite these positive trends, challenges remain. Tunisia’s fiscal crisis, legal uncertainties, and limited investor protections continue to constrain Chinese private sector enthusiasm, suggesting that the relationship, while symbolically important, remains modest compared to China’s ties with Tunisia’s Maghreb neighbors.

Tunisia has approached security relations with China through pragmatic engagement rather than formal alignment. Beijing has been crucial to Tunis’ efforts to diversify its arms suppliers; however, Tunisia-China military cooperation remains cautious and limited. China’s engagement with Tunisia is more evident in dual-use and technology, including within digital security and space cooperation. Tunisia hosts a Beidou satellite center, indicating collaboration in satellite positioning and potentially military-related technologies.46

China has also played a limited role in Tunisia’s defense acquisitions, which are mainly Western and domestic. Generally, Tunisia aligns with Western strategies while maintaining relations with China. The latter’s focus is on soft security tools, rather than hard power, to avoid disrupting Tunisia’s existing security partnerships.

Libya: Opportunities Amidst Instability

Since Gaddafi’s fall in 2011, Libya has suffered from political instability. Despite this, China has gradually renewed its engagement, guided by the principles of non-interference, economic pragmatism, and its long-term interests grounded in the framework of the BRI. Between 2020-2025, Chinese–Libyan ties deepened across the diplomatic, economic, and security domains, despite the nine-year closure of Beijing’s embassy in Tripoli due to domestic instability.47

Since 2020, Beijing has cautiously reengaged both of Libya’s key political camps—the internationally recognized Government of National Unity (GNU) in Tripoli and the eastern-based Libyan National Army (LNA) under Khalifa Haftar.48 This dual-track diplomacy reflects China’s hedging strategy, aimed at preserving long-term interests.

In September 2024, both countries signed a Strategic Partnership during a visit by Mohamed al-Menfi, Chairman of the Libyan Presidency Council, to Beijing, where he attended the Forum on China-Africa Cooperation.49 That same year, trade between both countries reached nearly $5 billion, mostly composed of Libyan crude oil exports and Chinese sales of machinery, electronics, and consumer goods.50 China’s engagement in Libya is increasingly seen through the lens of the BRI, especially as Beijing frames reconstruction as a potential avenue for a long-term partnership.

A return to stability could revive several dormant contracts for Chinese state-owned enterprises in Libya, including railway and telecom projects. In 2024, Libya invited Chinese proposals for the rebuilding of Tripoli airport and a coastal highway; discussions are ongoing. Libya’s strategic location and energy resources make it a potential BRI hub in a post-conflict future, and China is interested in diversifying its energy suppliers and investing in the oil sector. China’s approach in Libya combines strategic neutrality and diplomatic backing for UN-led solutions with a major economic presence focused on oil and infrastructure. It has cautiously expanded security engagement, reportedly supplying Haftar’s forces with drones,51 while formalizing a strategic partnership that links Libya to China’s BRI network.

Conclusion

China’s evolving engagement with the Maghreb highlights a strategic shift in its broader policy towards Africa and the Mediterranean region. While focusing on infrastructure, resource security, and pragmatic diplomacy, China has managed to establish durable partnerships with key regional players despite political instability, regional tensions, and competition from Western powers. The region’s strategic location, abundant natural resources, and growing markets make it an essential component of China’s long-term vision for global influence, trade diversification, and resource access.

Looking ahead, Beijing’s emphasis on sovereignty, non-interference, and win-win cooperation will likely enable it to deepen its footprint in the Maghreb, shaping the region’s economic trajectories and diplomatic alignments. However, sustained engagement will require it to navigate regional complexities and addressing skepticism from local and international actors, to ensure that China’s presence remains both influential and mutually beneficial. As Beijing continues to deepen its presence, the Maghreb could emerge as a key hub in China’s global connectivity and resource diversification strategies.

Endnotes

1 Anniek Bao, “Chinese lenders have a massive challenge: They can’t lend enough,” CNBC, January 9, 2025, https://www.cnbc.com/2025/01/10/chinese-commercial-banks-have-a-challenge-they-cant-lend-enough-and-.html?utm.

2 This Issue Brief concentrates specifically on Algeria, Libya, Morocco, and Tunisia; thus, it excludes Mauritania, which is the fifth member of the Arab Maghreb Union, created in 1989.

3 Hang Zhou, “China’s Balancing Act in the Western Sahara Conflict,” in Africana Studia, no.29 (2018), https://ojs.letras.up.pt/index.php/AfricanaStudia/article/view/7635.

4 The Arab Spring disrupted Chinese–North African economic ties. Before Libya’s 2011 uprising, China imported about 150,000 barrels of oil per day from Libya—10% of the country’s oil exports and 3% of its own oil needs. The conflict following Gaddafi’s overthrow halted this trade, but by 2018, Libya’s annual oil exports to China had rebounded to $3.8 billion. See: Frederic Wehrey and San Alkoutami, “China’s Balancing Act in Libya,” Lawfare (blog), May 10, 2020, https://www.lawfaremedia.org/article/chinas-balancing-act-libya.

5 Calculated from AEI/China Global Investment Tracker, “Chinese Investments & Contracts in Algeria (2005 – 2025),” accessed September 2, 2025, https://www.aei.org/china-global-investment-tracker/.

6 UN Comtrade, “Trade Data,” accessed September 16, 2025, https://comtradeplus.un.org/.

7 United Nations, “Questions relating to Asia and the Far East,” Yearbook of the United Nations (New York: United Nations, 1971), Ch. 8, pp. 129-130, https://cdn.un.org/unyearbook/yun/chapter_pdf/1971YUN/1971_P1_SEC1_CH8.pdf.

8 A retired senior Algerian diplomat, interview by author, Algiers, Algeria, September 2, 2020; Li Lianhe [former Ambassador of China to Algeria], “La Chine et l’Algérie œuvrent la main dans la main pour réaliser leurs rêves” [China and Algeria work hand in hand to achieve their dreams], Le Jeune indépendant, September 30, 2021,

https://www.jeune-independant.net/la-chine-et-lalgerie-oeuvrent-la-main-dans-la-main-pour-realiser-leurs-reves.

9 Degang Sun, “China’s Partnership Diplomacy in the Middle East,” The Asia Dialogue, March 24, 2020, https://theasiadialogue.com/2020/03/24/chinas-partnership-diplomacy-in-the-middle-east/.

10 Yang Sheng, “China, Algeria to inherit, promote traditional friendship for ‘better global governance,” Global Times, July 17, 2023, https://www.globaltimes.cn/page/202307/1294528.shtml.

11 Algerian Ministry of Foreign Affairs, “Algeria, China sign 2nd five-year comprehensive strategic cooperation plan 2022-2026,” press release, November 8, 2022, https://www.mfa.gov.dz/press-and-information/news-and-press-releases/algeria-china-sign-2nd-five-year-comprehensive-strategic-cooperation-plan-2022-2026.

12 “Algeria supports three Chinese initiatives, eager to join BRICS: President Tebboune,” CGTN, July 23, 2023, https://news.cgtn.com/news/2023-07-23/Algeria-supports-three-Chinese-initiatives-eager-to-join-BRICS-1lFhmKHqAGA/index.html.

13 Yahia H. Zoubir and Xuanrong Wu, “Algeria at the BRICS’ Doorstep: A Journey of Aspirations and Opportunities,” Afkār (blog), December 17, 2023, https://mecouncil.org/blog_posts/algeria-at-the-brics-doorstep-a-journey-of-aspirations-and-opportunities/.

14 Chinedu Okafor, “China is set to invest $36 billion in some of Algeria’s key economic sectors,” Business Insider, July 21, 2023, https://africa.businessinsider.com/local/markets/china-is-set-to-invest-dollar36-billion-in-some-of-algerias-key-economic-sectors/l4l8p5k.

15 “China Algeria trade hits USD 4.5B as Partnership Deepens,” Waya, April 16, 2025, https://waya.media/china-algeria-trade-hits-usd-4-5b-as-partnership-deepens/; Rabia Abdul Salam, “Algeria and France unravel their last remaining trade links,” Al Majalla, March 3, 2025, https://en.majalla.com/node/324567/business-economy/algeria-and-france-unravel-their-last-remaining-trade-links.

16 CITIC Construction, Global Market Infrastructure (Beijing: CITIC Construction, March 2025), p. 61, https://www.construction.citic/uploads/2025-03-03/58705a1b-0566-45e6-8d8f-e58997960a881740962894226.pdf?utm; “Expansion of the highway network to reshape land transport,” in The Report: Algeria 2014 (Oxford, UK: Oxford Business Group, 2014), https://oxfordbusinessgroup.com/reports/algeria/2014-report/economy/expansion-of-the-highway-network-to-reshape-land-transport?utm.

17 “Islamic development bank to lend Algeria $3 billion for projects over next 3 years,” Reuters, May 19, 2025, https://www.reuters.com/world/africa/islamic-development-bank-lend-algeria-3-billion-projects-over-next-3-years-2025-05-19.

18 Rafik Tadjer, “Algérie: plongée dans un chantier ferroviaire hors normes en plein désert” [Algeria: A dive into an extraordinary railway construction site in the middle of the desert], TSA, July 2, 2025, https://www.tsa-algerie.com/algerie-plongee-dans-un-chantier-ferroviaire-hors-normes-en-plein-desert/; Florian Guénet. “Maghreb: la Chine a un projet pharaonique dans ce pays” [Maghreb: China has a pharaonic project in this country], La Nouvelle Tribune, January 5, 2025, https://lanouvelletribune.info/2024/01/maghreb-la-chine-a-un-projet-pharaonique-dans-ce-pays/.

19 Ibrahima Diallo, “Government mobilizes $3,2 billion for construction of new railways,” Africa Supply Chain, January 17, 2024, https://africasupplychainmag.com/en/Algeria-government-mobilizes-32-billion-for-the-construction-of-new-railways.

20 The two also signed major energy agreements in May 2022 (a $490 million contract for joint production of oil) and February 2025 (an $850 million contract with Sinopec). Ali Idir, “Total, Sinopec…: l’Algérie attribue 5 permis d’exploration d’hydrocarbures” [Total, Sinopec…: Algeria awards 5 hydrocarbon exploration permits], TSA, June 17, 2025, https://www.tsa-algerie.com/total-sinopec-lalgerie-attribue-5-permis-dexploration-dhydrocarbures/.

21 “One of the largest in the world: The Bled El Hadba phosphate mine comes on stream,” Algeria Invest, November 17, 2024, https://www.algeriainvest.com/premium-news/cest-lune-des-plus-grandes-au-monde-la-mine-de-phosphate-de-bled-el-hadba-entre-en-exploitation.

22 Hana Saada, “Algeria, China Forge Strategic Investment Alliance with Eight Major Agreements,” Dzair Tube, April 15, 2025, https://www.dzair-tube.dz/en/algeria-china-forge-strategic-investment-alliance-with-eight-major-agreements/?utm; “Partnership between Iris and Chery to Manufacture cars in Algeria,” Motor Beats, April 15, 2025, https://motorbeats.com/en/car-news/partnership-between-iris-and-chery-to-manufacture-cars-in-algeria/.

23 Cherif Lahdiri, “Le partenariat sino-algérien en pleine ascension” [The rapidly growing Sino-Algerian partnership], El Watan, April 17, 2025, https://elwatan-dz.com/le-partenariat-sino-algerien-en-pleine-ascension.

24 “Algeria unveils winners of its 2 GW solar auction, Chinese firms dominate,” Enerdata, November 7, 2023, https://www.enerdata.net/publications/daily-energy-news/algeria-unveils-winners-its-2-gw-solar-auction-chinese-firms-dominate.html?.

25 Ibid.

26 Yahia H. Zoubir, “Algeria’s Balancing Act between Historical Partnership with Russia and Independence,” ISPI, September 4, 2024, https://www.ispionline.it/en/publication/algerias-balancing-act-between-historical-partnership-with-russia-and-independence-182969.

27 Yahia H. Zoubir, Algeria-Russia Ties: Beyond Military Cooperation?, Issue Brief, (Doha, Qatar: Middle East Council on Global Affairs, January, 2024), https://mecouncil.org/publication/algerian-russian-relations-military-cooperation/.

28 “Algeria, China: Mediterranean expansion for military agreements?” Tactical Report, June 9, 2022, https://www.tacticalreport.com/daily/59749; U.S. Department of Defense, “Military and Security Developments Involving the People’s Republic of China,” 2023 Annual Report to Congress (Washington, D.C., Department of Defense, 2023), p. 171, https://media.defense.gov/2023/Oct/19/2003323409/-1/-1/1/2023-MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA.PDF.

29 Darek Liam, “Algeria to build Chinese corvettes locally,” Military Africa, January 4, 2025, https://www.military.africa/2025/01/algeria-to-build-chinese-corvettes-locally/.

30 Farid L. “Algérie – Chine : l’armée veut acquérir le lanceur de missiles SY-400” [Algeria – China: Army wants to acquire SY-400 missile launcher], Algerie360, December 1, 2022, https://www.algerie360.com/algerie-chine-larmee-veut-acquerir-le-lanceur-de-missiles-sy-400/; “Hong Qi 9 (HQ-9): Chinese Air Defense Missile System,” MilitaryView, accessed September 3, 2025, https://militaryview.com/hong-qi-9-hq-9-chinese-air-defence-missile-system/.

31 Eleanor Albert, “Which countries support the new Hong Kong National Security Law,” The Diplomat, July 6, 2020, https://thediplomat.com/2020/07/which-countries-support-the-new-hong-kong-national-security-law/? ; Catherine Putz, “2020 edition: Which countries are for or against China’s Xinjiang policies,” The Diplomat, October 9, 2020, https://thediplomat.com/2020/10/2020-edition-which-countries-are-for-or-against-chinas-xinjiang-policies/.

32 Wu Wanjun and Pedro Sobral, “China’s Non-interference Policy towards Western Sahara Conflict,” Africana Studia no. 29 (2018), pp. 131-143, https://repositorio.ulisboa.pt/bitstream/10400.5/28742/1/China%E2%80%99s%20Non-interference%20policy%20towards%20the%20Western%20Sahara.pdf.

33 Ahmed Obeidat (former prime minister and senator), interview by author(s),

Amman, Jordan, September 4, 2014.

34 Yassine Madjdi, “From Mirage to Reality: The Real Story of the Tanger Tech,” TelQuel, January 8, 2025, https://telquel.ma/2025/01/08/from-mirage-to-reality-the-real-story-of-tanger-tech_1912054.

35 United Nations Comtrade Database, “Trade Statistics,” accessed September 3, 2025, https://comtrade.un.org/Data/.

36 Ministry of Foreign Affairs, People’s Republic of China, “China and Morocco,” https://www.fmprc.gov.cn/eng/gjhdq_665435/2913_665441/2858_663706/.

37 Trading Economics , “Morocco Exports to China,” https://tradingeconomics.com/morocco/exports/china.

38 “Business relations between Morocco and China: a rapidly expanding partnership,” GIDE, March 18, 2025, https://www.gide.com/en/news-insights/business-relations-between-morocco-and-china-a-rapidly-expanding-partnership/.

39 “As Western Ties Shift, Morocco Turns to China for Advanced Military Drones,” Defense Security Asia, March 9, 2025, https://defencesecurityasia.com/en/as-western-ties-shift-morocco-turns-to-china-for-advanced-military-drones/.

40 Louis Dugit-Gros, Sabina Henneberg, “China’s Presence in Tunisia: How Far Has It Come, and Where Is It Headed?” Policy Watch 3728, The Washington Institute for Near East Policy, April 6, 2023, https://www.washingtoninstitute.org/policy-analysis/chinas-presence-tunisia-how-far-has-it-come-and-where-it-headed?.

41 Ministry of Foreign Affairs People’s Republic of China, “China and Tunisia,” https://www.fmprc.gov.cn/eng/gjhdq_665435/2913_665441/2893_663786/#:~:text=Bilateral%20trade%20has%20grown%20steadily,textiles%2C%20apparel%20and%20other%20products.

42 Yin Yeping, “BRI paves the way for expanded China-Tunisia cooperation in infrastructure, agriculture, trade, and more: envoy,” Global Times, November 26, 2024, https://www.globaltimes.cn/page/202411/1323817.shtml.

43 “Tunisia & China Plan for Enhanced Partnerships,” The World Monitor, January 13, 2024, https://www.theworldmonitor.com/tunisia-china-plan-for-enhanced-partnerships/.

44 Dugit-Gros and Henneberg, “China’s Presence in Tunisia.”

45 “Tunisia Strengthens Its Presence in the Chinese Market,” Tunisie Numérique, May 31, 2025, https://news-tunisia.tunisienumerique.com/tunisia-strengthens-its-presence-in-the-chinese-market/.

46 Ellie Young and Oumayma Ben Abdallah, “Beijing’s Global Media Influence 2022: Tunisia,” Freedom House, 2022, https://freedomhouse.org/ar/country/tunisia/beijings-global-media-influence/2022.

47 The embassy, closed in 2016 due to insecurity, was reopened in 2025. See: “China to Reopen Embassy in Libyan Capital,” Libya Review, April 29, 2025, https://libyareview.com/55230/china-to-reopen-embassy-in-libyan-capital.

48 Bilal Abdullah, “Calculations and Future of China’s Role in Libya,” Emirates Policy Center, December 13, 2024, https://epc.ae/en/details/scenario/calculations-and-future-of-china-s-role-in-libya.

49 State Council of the People’s Republic of China, “China, Libya establish strategic partnership as leaders meet in Beijing,” press release (Beijing: State Council of the People’s Republic of China / Xinhua, September 4, 2024), https://english.www.gov.cn/news/202409/04/content_WS66d861d0c6d0868f4e8ea9ad.html.

50 The Observatory of Economic Complexity (OEC), “China / Libya,” accessed May 2025, https://oec.world/en/profile/bilateral-country/chn/partner/lby.

51 “Italy seizes Chinese-made military drones destined for Libya,” Reuters, July 2, 2024, https://www.reuters.com/world/italy-seizes-chinese-made-military-drones-destined-libya-2024-07-02/.