Gas, Growth, and Green Ambitions:

Qatar’s Climate Blueprint

Policy Paper, May 2025

Abstract

Despite being frequently singled out in global climate discourse, Qatar has proactively committed to achieving a 25% reduction in greenhouse gas emissions by 2030 through a carefully tailored, sector-specific decarbonization strategy. Central to this approach are advanced technological interventions, including Carbon Capture and Storage (CCS) and the accelerated integration of renewable energy sources. Considering Qatar’s centralized governance structure, substantial economic dependence on hydrocarbon exports, and relatively nascent financial market infrastructure, the country is particularly suited to a Command-and-Control (CaC) regulatory framework rather than complex market-based carbon pricing mechanisms. The CaC framework harnesses Qatar’s streamlined decision-making capabilities, robust institutions, and targeted capacity-building initiatives, ensuring rapid and measurable progress toward its emissions reduction targets. This approach strategically aligns effective emissions reduction efforts with sustained economic resilience, safeguarding Qatar’s competitiveness while simultaneously enhancing its ability to maximize foreign revenue generation from LNG exports.

Key Recommendations

Establish a Robust Command-and-Control (CaC) Regulatory Framework: A centralized CAC regulatory framework with standardized greenhouse gas emissions reporting across sectors aligns with Qatar’s governance structure and hydrocarbon-based economy. Establishing a centralized data management system would enhance transparency, facilitate compliance verification, and enable effective emissions monitoring.

Develop Strategic Technological and Emissions Benchmarks: Developing technological and emissions benchmarks tailored to sector-specific contexts would enable Qatar to effectively achieve its decarbonization objectives. This includes adopting legislation on Best Available Technologies (BAT), methane leak detection and repair (LDAR) programs, zero-flaring policies, and stringent monitoring.

Expand Climate Finance Initiatives and Technical Expertise: In addition to its sovereign green financing framework, the strategic deployment of concessional financing instruments in (and beyond) Qatar will stimulate sustainable regional growth, promote technical capacity-building, and establish Qatar as a leader in climate finance innovation and technological development.

Leverage Strategic International Carbon Market Engagement: Strategic and methodical engagement with international carbon market mechanisms under Article 6 of the Paris Agreement presents significant opportunities. Leveraging bilateral climate agreements could attract global investments in areas such as energy efficiency, renewable energy, and economic diversification.

Introduction: Balancing Carbon Intensity with Economic Growth

For decades, Qatar has occupied a unique position on the global stage: with vast natural gas reserves, the nation has the world’s highest per capita carbon emissions, yet it only contributes, and has contributed, minimally to global greenhouse gas totals. This conundrum lies at the heart of Qatar’s climate challenge a balancing act between leveraging its hydrocarbon wealth and responding to the mounting global pressure to decarbonize. As Qatar embarks on ambitious carbon reduction strategies, including a commitment to cutting greenhouse gas emissions by 25% by 2030, pioneering Carbon Capture and Storage (CCS) technologies, and investing in renewable energy, it confronts a deeper question: how can it reconcile its economic dependence on natural gas with its responsibility toward global climate action, all the while fostering its macroeconomic growth?

Despite Qatar’s exceptionally high per capita carbon emissions (37.6 tons per person in 2022, the world’s highest), a historical perspective reveals significant trends (see Figure 1). Emissions peaked during the early 1960s (following the establishment of OPEC) and again in 1990 (due to the North Field development project), demonstrating sharp increases linked to hydrocarbon exploitation, an energy-intensive economy, and a relatively small population (2.7 million in 2023). However, since the early 2000s, a steady decline has been evident. Despite these challenges, projections suggest a stabilization or further incremental decline in Qatar’s per capita emissions. This is attributed to ongoing decarbonization initiatives targeting key economic sectors, the expansion of renewable energy capacity, and anticipated population growth.

Source: Our World in Data, based on data from the Global Carbon Budget 2024 Annual Report.1

Qatar has reduced its peak per capita emissions significantly since 1963, when they reached approximately 120 tons. However, its total greenhouse gas emissions continue to rise due to ongoing economic growth and natural gas production. Despite this, Qatar like its regional neighbors contributed a relatively small share of global emissions, totaling around 115 MMT in 2023, or just 0.31% of the global total (see Figures 2 and 3).

Source: Our World in Data, based on data from the Global Carbon Budget 2024 Annual Report.2

Compared to its energy-rich neighbors, such as the UAE and Saudi Arabia—both of which have introduced extensive climate mitigation policies—Qatar has adopted a more measured approach to climate action, shaped by the economic realities of its position as a major natural gas producer. This difference in emissions reduction strategies should not be interpreted as a lack of commitment on Qatar’s part, but rather as a reflection of the distinct economic considerations associated with its vast North Field natural gas reserves. These reserves provide a stable and substantial revenue stream for Qatar’s relatively small population, influencing its approach to balancing economic growth with environmental responsibility.

In addition to the consistent revenue stream, Qatar’s abundant natural gas reserves shield it from the challenges of allocation shortfalls and the budgetary constraints associated with maintaining low domestic natural gas prices amid rising production costs from unassociated gas reserves. These economic pressures, which have driven Saudi Arabia and the UAE to accelerate their decarbonization efforts, are comparatively less urgent for Qatar in the long term.

Source: Our World in Data, based on data from the Global Carbon Budget 2024 Annual Report.3

Qatar’s climate strategy focuses on several key areas. As part of its broader sustainable development agenda, the country plans to integrate renewable energy sources (i.e., solar) into 30 percent of its energy mix by 2030.4 Additionally, Qatar’s 2021 National Climate Change Action Plan outlines a framework for achieving a 25 percent reduction in emissions by the same year.5 Qatar has not yet announced a national net-zero target and has expressed skepticism toward the net-zero commitments made by Saudi Arabia and the UAE, suggesting they lack concrete implementation plans. Energy Minister Saad Al-Kaabi remarked, For me to just come out and say net-zero 2050 would be very sexy… but it’s not the right thing.” He further criticized the trend of setting ambitious climate targets without clear roadmaps, stating that many politicians are just throwing it out there without a plan. Al-Kaabi also cautioned that moving too quickly without a well-defined strategy could lead to underinvestment in oil and gas, ultimately driving up costs for consumers due to supply shortages.6 Instead, Qatar’s approach centers on pragmatic sector-specific emissions reductions, particularly within the LNG industry. This strategy prioritizes CCS technologies, with goals of a 15 percent net reduction in carbon intensity from upstream operations and a 25 percent reduction within LNG facilities by 2030, covering both direct and indirect emissions. It is essential to recognize that these targets focus on reducing carbon intensity lowering emissions per unit of output rather than achieving absolute emission reductions. This approach enables Qatar to sustain economic growth and expand LNG production while working to mitigate the environmental impact per unit of energy produced.

Qatar’s initial foray into carbon markets mirrored Dubai’s contemporaneous ambitions, with a planned launch of a Doha-based system in 2009. However, the global financial crisis disrupted these plans. Undeterred by this setback, Qatar focused more on the international dimensions of carbon and strategically invested in organizations disseminating institutional knowledge on carbon reduction approaches and carbon market development throughout the Middle East and North Africa (MENA) region.

This includes initiatives such as the Global Carbon Council (GCC), which serves as the first carbon credit certification body in the region, supporting the implementation of emission reduction projects. Similarly, the Gulf Organization for Research & Development (GORD) has played a role in promoting climate-conscious infrastructure and sustainability frameworks, particularly through its Global Sustainability Assessment System, which advances energy-efficient and low-carbon building practices.

Moreover, it has collaborated with international organizations such as the International Emissions Trading Association (IETA) and various regional policy networks to explore carbon pricing mechanisms and share expertise on emissions reduction frameworks. Through these engagements, Qatar has positioned itself as a contributor in shaping carbon markets and emissions reduction strategies in MENA.

Additionally, Qatar demonstrated its leadership in climate diplomacy by hosting COP 18 in 2012, a move that reinforced its commitment to global climate discussions despite its continued reliance on hydrocarbon revenues. While Qatar has not yet established a domestic carbon trading system, these strategic investments in institutional capacity, carbon credit frameworks, and policy discussions highlight its broader strategy to leverage the international climate movement to support its economic and sustainability goals. As with other Gulf nations, Qatar recognizes the need to address knowledge and capacity limitations in developing sustainable environmental frameworks for carbon emissions reduction. To address this challenge, Qatar is investing significantly in local universities and R&D facilities. This aligns with the nation’s broader strategy to transition toward a knowledge-based economy and supports a wide array of postgraduate programs and collaborative research focused on sustainability. The establishment of the Qatar Science and Technology Park (QSTP) in 2009 is one of its earliest efforts to foster partnerships with international corporations and leading research institutions in the field of innovative carbon emissions reduction technologies (such as CCS).7

In addition to its broader investments in R&D, Qatar Foundation established the Qatar Environment and Energy Research Institute (QEERI). QEERI focuses on the intersection of energy systems and climate change mitigation, aiming to bridge research gaps in both areas. Qatar’s dedication to climate change research is commendable, with significant funding allocated to the field. However, the current focus appears to favor technological solutions for CCS. While valuable for Qatar’s national economic interests in the hydrocarbon sector, this emphasis may overlook the broader social, political, cultural, and economic factors contributing to the nation’s high per capita carbon emissions. A more comprehensive, interdisciplinary approach to climate change research could offer significant benefits. By incorporating disciplines such as economics, sociology, and political science, research efforts could delve deeper into the root causes of Qatar’s emissions profile. This could lead to the development of more robust institutional capacity building for the Qatari government to address climate challenges.

Beyond the Flare: Qatar’s Quest for Sustainable Gas Production

Gas flaring poses an environmental and economic challenge for Qatar, accounting for approximately 2% (2 MMT) of its total annual greenhouse gas emissions. Although relatively modest in overall scale, this figure nevertheless reflects inefficient utilization of valuable natural gas resources.8 Despite a substantial reduction from peak flaring levels of nearly 9 MMT in the 1970s, further improvements remain essential. Reducing gas flaring represents a low-hanging fruit for Qatar an accessible and cost-effective opportunity to achieve meaningful carbon reductions, optimize resource monetization, and deliver tangible environmental and economic benefits (See Figure 4).

Source: Our World in Data, based on data from the Global Carbon Budget 2024.9

Recognizing the detrimental environmental impacts—as well as the opportunity cost—of flaring, Qatar proactively joined the World Bank’s Global Gas Flaring Reduction Partnership (GGFR) in 2009, becoming the first Gulf nation to do so.10 As part of this initiative, Qatar Energy (QE) committed to the goal of “Zero Routine Flaring by 2030.” To further bolster its commitment, in 2021, Qatar became a member of the GGFR Multi-Donor Trust Fund, seeking stronger partnerships to address flaring globally. QE aligns these efforts with its Sustainability Strategy, which aims to drastically reduce flaring intensity across upstream infrastructure by over 75 percent.11

Furthermore, QE has set the ambitious goal of mitigating fugitive emissions to a methane intensity target of 0.02 percent across all facilities by 2025.12 However, significant challenges remain. Qatar vented approximately 87 MMT of methane in 2023, representing 0.8 percent of global methane emissions (See Figure 5). Addressing methane emissions will be critical as Qatar progresses with its major LNG expansion plans—aiming for an 85 percent increase in LNG output from the North Field (from 77 mtpa to 142 mtpa by 2030). Without robust mitigation strategies, this expansion will lead to a further increase in methane emissions.

Source: Our World in Data, Based on data from Jones et al. (2024).13

Qatar has had some early success in implementing gas recovery and emissions reduction projects. For instance, the Al-Shaheen Oil Field and Gas Recovery and Utilization Project was launched in 2007 as Qatar’s first UNFCCC Clean Development Mechanism (CDM) and the inaugural Kyoto Protocol-compliant carbon credit scheme in the Middle East. The Al-Shaheen project significantly reduced gas flaring in its reservoir and generated revenue from carbon credit sales.14 However, the project faced criticism regarding its compliance with CDM additionality requirements, raising concerns about whether the emissions reductions would have occurred independently of CDM incentives. While Qatar demonstrated early success with the Al-Shaheen, the broader MENA region struggled to scale CDM initiatives, with only 23 registered projects. Limited institutional capacity, financial barriers, and the complexities of the CDM approval process may have hindered further expansion. In response, Qatar redirected its climate strategy toward sector-specific emissions reduction efforts.

Recognizing the limitations of CDM expansion, Qatar instead focused on targeted emissions reduction projects within key industries, including LNG production, petrochemicals, and energy efficiency. As part of its sectoral emissions reduction efforts, Qatar launched the Jetty Boil-Off Gas Recovery Project in 2014, which captures LNG boil-off gas during loading operations, leading to an estimated annual reduction of 1.6 MMT in GHG emissions.15 Additionally, the Qatar Fuel Additives Company Limited (QAFAC) project recovers approximately 500 tons of carbon dioxide daily, converting it into methanol.16 Other significant endeavors include the Qatar General Electricity and Water Corporation (Kahramaa) project (2012-2017), which achieved an 8.5 MMT reduction in carbon emissions.17

Qatar’s energy efficiency and emissions reduction efforts have also been buttressed by the National Rationalization and Energy Efficiency Program (Tarsheed). Launched in 2012, Tarsheed augmented Qatar’s progress towards climate change mitigation and emissions reduction within the energy sector. By the end of 2021, the second phase of the program had achieved significant results, with reported savings of over $1.1 billion.18 During its first decade of operation, Tarsheed conserved approximately 14,000 gigawatt-hours of electricity, over 100 million cubic meters of water, and nearly 4 BCM of natural gas. These efforts have translated into a reported reduction of approximately 8.5 MMT of carbon emissions.19 Parallel to these efforts, to further address emissions, the Qatari government established the National Flaring and Venting Reduction Project, which specifically targets major contributors to flaring within the industry.20 However, as Qatar continues to expand both its LNG sector and its macroeconomy, these initiatives will have to be reinforced by institutional capacity and a dedicated drive to further reduce emissions.

Qatar’s Climate Code: Legal Frameworks for a Greener Future

Qatar’s institutional commitment to environmental sustainability began with the establishment of the Standing Committee for Environmental Protection in 1981 under Law No. 4 of 1981, overseen by the Ministry of Municipal Affairs and Agriculture.21 This marked the first formalized effort to regulate environmental issues in the country. In 2000, the committee was replaced by the Supreme Council for the Environment and Natural Reserves following the enactment of Law No. 11 of 2000, which expanded Qatar’s environmental governance framework.

Further strengthening its environmental policies, the Qatari government introduced Law No. 30 of 2002 (the Environmental Protection Law) in September 2002.22 This comprehensive legislation, consisting of eighty articles, set forth detailed regulations for environmental protection, conservation, and sustainable management of Qatar’s ecosystem.

Qatar formally integrated sustainability into its national economic planning with the launch of Qatar National Vision 2030 (QNV 2030) in 2008, which established sustainable development as one of its four foundational pillars. This vision provided the long-term framework for economic, social, and environmental growth. Building on this foundation, the National Development Strategy 2011–2016 (NDS 2011–2016) operationalized these principles, outlining specific policy goals related to sustainability. However, at the time, Qatar still lacked a comprehensive national carbon mitigation strategy or specific emissions reduction targets.

Qatar’s environmental and energy sectors are overseen by two primary governmental bodies. The Ministry of Environment and Climate Change (MECC), established in late 2021, is a successor to the Ministry of Municipality and Environment (MME). Inheriting the MME’s environmental and climate responsibilities, this restructuring reflects Qatar’s growing political understanding of the need to establish a dedicated agency for climate action and decarbonization efforts. Alongside the MECC, the Ministry of Energy and Industry (MEI) is the other important agency in shaping energy policy and regulation within Qatar’s energy sector. QE also carries out regulatory functions within the industry and has its imprint on decarbonization policies. It is important to note, however, that the MECC’s influence is limited in certain industrial hubs such as Ras Laffan, Mesaieed, and Dukhan.23 Companies operating within these cities primarily report to QE. However, nation-wide, a comprehensive environmental impact assessment process is mandated for most large and medium/small-scale industrial and hydrocarbon projects.

Qatar’s energy sector operates within a well-defined regulatory framework established by the cornerstone Natural Resources Law (Law No. 3) of 2007. This law governs the exploration and exploitation of natural resources within the country. The Ministry of Energy and Industry (MEI) oversees hydrocarbon policy, ultimately under the authority of the Emir. QE manages and develops these resources and also acts as a regulator for many hydrocarbon operations. Environmental considerations are addressed by the MECC, which establishes environmental policies and legal/administrative regulations for hydrocarbon and petrochemical projects. These regulations aim to ensure compliance with environmental standards regarding emissions and discharges during processing. Furthermore, the MECC assists in the development of a comprehensive national climate change program. This program includes policies to manage national GHG emissions, adherence to international commitments under multilateral climate treaties, and the preparation and publication of National Communications under the UNFCCC. Furthermore, the MECC also serves as the national focal point for all climate change issues within Qatar.

Qatar’s Environmental Protection Law and Regulation grants its Environmental Assessment Department the authority to set emissions limits and impose penalties for noncompliance, including the potential withdrawal of an entity’s operating consent.

However, limited publicly available data on corporate compliance, enforcement actions, or license suspensions makes it difficult to assess regulatory transparency and accountability. This lack of disclosure raises concerns about the effectiveness of enforcement mechanisms and the implementation of climate-related policies. Additionally, early phases of Qatar’s GHG reduction initiatives exhibited inconsistencies in enforcement, which can serve as potential challenges in ensuring uniform regulatory application across industries.

Qatar has demonstrated leadership in GHG emissions tracking, having developed its first comprehensive national GHG inventory in 2007, followed by subsequent updates in 2011, showcasing an early commitment to data-driven climate policy and emissions monitoring. This initial inventory encompassed carbon dioxide, methane, and nitrous oxide and was published within Qatar’s Initial National Communication to the UNFCCC. Qatar made a notable effort in advancing its climate policy framework by establishing the Climate Change and Clean Development Committee through Resolution of Ministers No. 15 of 2011. This resolution tasked relevant agencies with developing GHG reduction policies, implementing action plans, and creating a UNFCCC and Kyoto Protocol-compliant database. However, the initiative’s effectiveness was undermined by implementation challenges, largely due to weak enforcement mechanisms and limited institutional compliance. Many agencies failed to fully adhere to the directive, resulting in fragmented data collection and policy execution. While QE and select companies began incorporating emissions data into their sustainability reports, inconsistent data disclosure across industries remained a significant obstacle to achieving a cohesive and transparent emissions monitoring system.24

Initially, the lack of a legal mandate for carbon emissions reporting meant companies operated on a voluntary basis, resulting in inconsistent disclosure practices. However, the trend towards greater transparency gained momentum in 2011 with QE’s Health, Safety, and Environment (QP HSE) initiative to publish GHG emissions data. This prompted many companies to follow suit, incorporating emissions data into their annual sustainability reports. Despite this progress, data transparency remains incomplete as some companies still withhold information due to the absence of mandatory reporting requirements.25

Despite these challenges, Qatar’s engagement with carbon markets gained international attention when the Supreme Committee for Delivery & Legacy purchased carbon credits to offset emissions from the FIFA World Cup 2022, branding it as a “carbon-neutral” event. This move positioned Qatar as a regional leader in voluntary carbon offsetting and encouraged broader Gulf participation in carbon markets. By integrating market-based mechanisms into its climate strategy, Qatar contributed to the expansion of offset demand and the development of low-carbon projects in the Middle East. However, concerns remain over the transparency, credibility, and effectiveness of the offsets, raising questions about their role in achieving genuine emissions reductions.

Beyond Carbon Markets: A Targeted Framework for Qatar’s Emissions Strategy

Qatar’s pathway to emissions reduction should intentionally prioritize a Command-and-Control (CaC) regulatory framework over a market-based carbon pricing system. This strategic choice aligns with several characteristics of Qatar’s economic, political, and governance landscape. Firstly, Qatar’s highly centralized and streamlined governance structure favors a top-down regulatory approach that empowers rapid decision-making and the implementation of clear mandates.26 Qatar, in contrast to the UAE and Saudi Arabia, does not have to contend with a wide variety of industries with various vested interests in maintaining the status quo. As a result, the CaC model would align with Qatar’s strategy of the implementation of specific sectoral decarbonization initiatives and enable the rapid establishment of sector-specific emissions standards, compliance mechanisms, and enforcement procedures. Moreover, Qatar’s hydrocarbon industry, dominated by a few large state-owned entities, presents an ideal context for a CaC approach. This regulatory model empowers the government to directly establish ambitious emissions reduction targets for these entities, mandate the adoption of necessary technological upgrades, and allocate resources to support compliance efforts.

Additionally, Qatar’s limited institutional experience with advanced financial pricing mechanisms presents potential challenges. Unlike economies with robust financial sectors, such as Dubai or Saudi Arabia—where sophisticated financial hubs like the Dubai International Financial Centre (DIFC) and the Saudi Stock Exchange (Tadawul) facilitate the integration of complex trading instruments, including carbon pricing Qatar’s financial infrastructure remains relatively nascent. For instance, the Qatar Stock Exchange (QSE) predominantly engages in traditional equity and fixed-income securities trading, with limited exposure to derivatives or complex commodities trading. Moreover, specialized financial training institutes and a skilled workforce adept at managing intricate financial mechanisms are more readily available in Dubai and Saudi Arabia than in Qatar. These institutional capacity gaps could therefore hinder Qatar’s ability to rapidly develop a well functioning and efficient carbon market. Consequently, adopting a regulatory framework, as exemplified by the Supreme Committee for Delivery & Legacy’s stringent regulatory measures implemented for the FIFA World Cup 2022, offers Qatar a more familiar and immediately actionable pathway to achieve tangible emissions reductions. Furthermore, Qatar’s comparatively smaller and less diversified economy presents constraints for the effective implementation of a cap-and-trade (CaT) framework. Qatar does not have sufficient participants (both emitters and non-emitter entities) to generate a deep and liquid carbon market, which could lead to price volatility and hinder efficient price discovery mechanisms. Furthermore, Qatar’s high reliance on the hydrocarbon industry could result in a lack of diversity among major emitters, limiting the overall effectiveness of a CaT system as the potential for emissions reductions within a single sector might be limited. Lastly, Qatar’s development strategy historically features a strong role for the government in guiding economic activities and strategic investments. This aligns well with a CaC approach, enabling targeted public funding to incentivize technological innovation, infrastructure upgrades, and research and development in support of emission reduction goals.

Nonetheless, Qatar could strategically leverage certain international market mechanisms provided under Article 6 of the Paris Agreement to complement its domestic CaC framework. Specifically, Articles 6.2 and 6.4 present opportunities for Qatar to pursue bilateral climate agreements, which can attract international investment into energy efficiency, renewable energy, and economic diversification initiatives. Utilizing these international provisions would build upon Qatar’s prior experience with CDM projects and establish credibility within international climate forums, potentially creating a valuable pathway toward future regional and global carbon market integration.

Given these limitations, a CaC approach provides a more immediate and streamlined pathway for Qatar to achieve near-term and mid-term emissions reductions. While the long-term potential for market-based mechanisms remains a consideration, the current regulatory framework positions Qatar for rapid and measurable progress in its emissions reduction goals. However, this analysis acknowledges the dynamic nature of carbon markets within the Gulf region. The ongoing development of markets in neighboring countries such as Saudi Arabia and the UAE suggests a strengthening regional environment for a potential future Gulf carbon market. Qatar’s early adoption of a CaC approach could lay a valuable foundation, establishing emissions tracking systems and technological standards that facilitate eventual integration into a broader regional market framework.

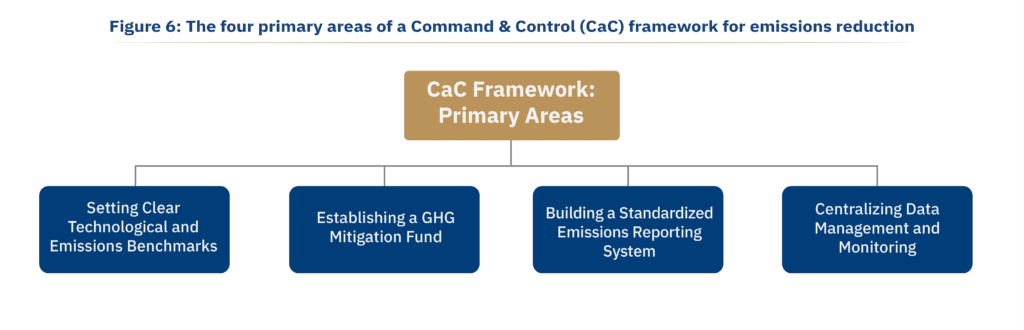

Given the enabling factors outlined above, Qatar can commence implementing a robust CaC framework to achieve its national decarbonization targets, economic growth plans, and its UNFCCC pledges through a streamlined two-stage approach.

Phase One: Laying the groundwork for effective decarbonization in Qatar

The initial phase of a CaC approach to emissions reduction, which could take approximately 3-4 years, demands the establishment of a robust foundation for subsequent initiatives in which the MECC will play an essential role and which encompass the following four primary areas:

1. Building a standardized emissions reporting system:

The MECC, working collaboratively with other relevant ministries and agencies, would spearhead the development of a comprehensive legal framework to mandate standardized GHG emissions reporting across all sectors of the Qatari economy. This framework would address several key elements to ensure consistency and accuracy of data. Defined guidelines would specify the frequency of emissions reporting (e.g., annual, biannual) as well as the specific types of emissions to be included (e.g., carbon dioxide, methane, and nitrous). Furthermore, the framework would outline a standardized methodology for emissions measurement and reporting.

This may involve adopting established international protocols, such as those set forth by the Intergovernmental Panel on Climate Change (IPCC), to ensure consistency and data comparability across entities. To facilitate efficient data submission, the framework would mandate the creation of a centralized data collection infrastructure. This could involve an online reporting portal or the use of specific software tools, such as the IPCC Inventory Software, the GHG Protocol Corporate Standard Tools, among others. The primary objective of this initiative would be to establish a clear and comprehensive baseline for Qatar’s GHG emissions, serving as a vital reference point for evaluating progress towards national emissions reduction targets.

2. Centralized data management and monitoring:

The MECC would serve as the central repository for all GHG emissions data, playing a critical role in data storage, analysis, and dissemination. To ensure the accuracy, integrity, and security of the collected emissions data, the MECC would establish a robust data management system. Furthermore, the MECC would be responsible for overseeing compliance with the established emissions reporting framework. This oversight involves activities such as implementing procedures for reviewing and verifying reporting accuracy (potentially through random audits or collaboration with independent verification bodies). Additionally, the MECC would generate compliance reports to identify entities meeting or falling short of reporting requirements. Finally, the MECC would have to collaborate with relevant authorities to enforce penalties for non-compliance, which may include fines or, for repeat offenders, suspension of operating licenses. Alongside the deterrence measures, capacity-building initiatives and targeted training programs would be implemented to ensure businesses fully understand and can effectively comply with the decarbonization requirements outlined in the CaC regulatory framework. This centralized approach would promote transparency and accountability and ensure adherence to established regulations.

3. Setting clear technological and emissions benchmarks:

Collaborating closely with industry experts and technology specialists, the MECC would also work to define technological and emissions benchmarks for different sectors of the Qatari economy. These benchmarks would serve as a tangible roadmap for achieving national emissions reduction goals. Key considerations in setting these benchmarks include: Mandating the adoption of Best Available Technologies (BAT), requiring the utilization of commercially viable and proven technologies that demonstrably minimize GHG emissions within specific industrial processes. Additionally, the benchmarks would encourage the phased implementation of advanced low-carbon technologies, such as renewable energy sources and energy-efficient infrastructure over defined timeframes. Finally, specific GHG emissions reduction targets would be established for different sectors, tailored to their unique emissions profiles and their potential for achieving reductions.

4. Establishment of a GHG mitigation fund:

The MECC would champion the establishment of a government-sponsored GHG mitigation fund to incentivize and accelerate decarbonization efforts and would be a key source of financial resources dedicated to additional decarbonization initiatives. Firstly, it would support R&D initiatives focused on innovative clean energy technologies, CCS systems, and advanced emissions reduction methodologies. Secondly, the fund would provide grants or subsidies to facilitate the deployment of low-carbon technologies across various sectors of the Qatari economy. Thirdly, it would allocate resources for capacity-building initiatives such as training programs that equip industries with the expertise necessary for implementing effective emissions reduction strategies. By creating a robust financial incentive structure, and potentially partnering with local institutions such as the Qatar Environment and Energy Research Institute (QEERI), Qatar University, or industry entities such as QE, the GHG mitigation fund would play a vital role in fostering technological innovation, accelerating the adoption of low-carbon solutions, and promoting a broader culture of emissions reduction across Qatar’s economy.

Phase Two: From data to action and strategic global engagement

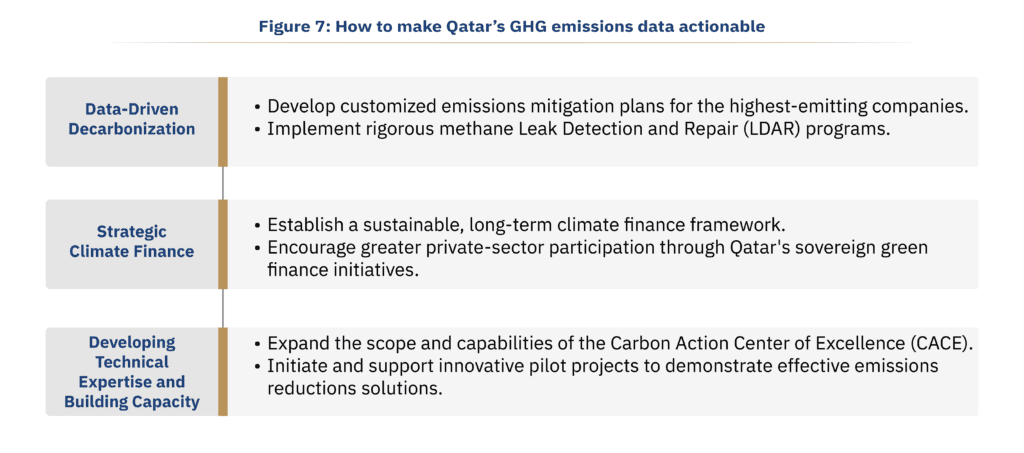

Phase Two of Qatar’s CaC approach would build upon the foundation established in Phase One. It would focus on leveraging the extensive GHG emissions data collected to drive targeted actions, capacity building, and strategic engagement in global climate finance initiatives.

1. Data-driven decarbonization:

The MECC will spearhead a comprehensive analysis of the extensive emissions data collected during Phase one. This in-depth analysis will pinpoint high-emission sectors, major emitters within those sectors, and the specific industrial processes generating the most significant greenhouse gas emissions. Identifying these key emission sources is key to developing targeted mitigation strategies.

Informed by the results of the emissions analysis, the MECC will develop tailored mitigation plans for the highest-emitting companies. These plans will outline specific mandates, such as the following: Companies will be required to replace inefficient machinery and processes with more energy-efficient technologies. To balance energy goals with economic realities, this transition may occur in phases over a defined timeframe. Additionally, strict methane Leak Detection and Repair (LDAR) programs will be implemented across all industries, particularly within the energy sector, likely involving mandatory equipment upgrades, regular monitoring schedules, and significant penalties for substantial leaks. Finally, the MECC will rigorously enforce existing zero-flaring policies, utilizing intensified monitoring, increased penalties for non-compliance, and potential collaborations with international organizations to implement advanced flare detection technologies.

2. Developing technical expertise and building capacity:

To effectively link foundational emissions data and strategic climate targets with practical decarbonization measures, Qatar can leverage its existing Climate Action Center of Excellence (CACE), established by the Gulf Organization of Research and Development (GORD) during COP28. CACE already provides essential technical assistance for navigating carbon markets, promotes international cooperation under Article 6 of the Paris Agreement, and supports emissions-reduction projects through targeted capacity-building initiatives. However, to fully achieve Qatar’s ambitious climate objectives, it would be beneficial to expand CACE’s current capabilities. Specifically, this could include enhancing its role in facilitating innovative research collaborations with international universities and research institutions, coordinating real-world pilot projects to demonstrate scalable decarbonization solutions, and broadening training programs tailored to industry professionals and governmental authorities. Through this expansion, CACE would further solidify Qatar’s position as a regional leader in sustainable innovation and emissions reduction strategies.

3. Strategic climate finance:

Leveraging the technical expertise and insights gained in Phases One and Two, Qatar would strategically position itself within the global climate finance landscape. The existing Sovereign Green Financing Framework established by Qatar’s Ministry of Finance provides an ideal institutional foundation for this strategy. Expanding upon this framework, Qatar could develop targeted financial instruments, such as concessional loans for renewable energy and low-carbon infrastructure projects across the MENA region and developing nations. This approach would mirror China’s strategic use of infrastructure financing initiatives, such as the Belt and Road Initiative, which simultaneously advance geopolitical influence and economic goals. By adopting this model, Qatar would generate revenue, reinforce regional decarbonization efforts, and strengthen its geopolitical influence through targeted climate investment programs.

Conclusion: Building Qatar’s Low-Carbon Legacy: A Roadmap for Transformation

The two-phased CaC approach presents a powerful roadmap for Qatar towards achieving its ambitious decarbonization goals. Phase One would lay the groundwork by establishing a robust institutional framework that incorporates standardized emissions reporting, rigorous data collection and monitoring systems, clearly defined technological and emissions benchmarks, and targeted financial incentives. Building upon this solid foundation, Phase Two would strategically transition from planning to action. Here, data-driven analysis would illuminate key areas for emissions reduction, enabling the development of targeted mitigation plans for high-emitting sectors. Concurrently, Qatar would leverage its newfound knowledge and expertise to ascend as a regional leader in decarbonization efforts.

Dedicated climate research-oriented organizations, strengthened by strategic international partnerships, would stimulate innovation, oversee rigorous pilot testing of emerging technologies, and facilitate comprehensive capacity-building initiatives to equip local industries with the necessary skills and resources for transformative change. Moreover, targeted climate finance initiatives would expedite decarbonization across the MENA region while simultaneously enhancing Qatar’s geopolitical stature and global influence. While the proposed CaC approach offers a well-structured path, continued success hinges upon several critically important factors. First and foremost, adaptability is vital. Therefore, regular and consistent evaluations and updates to the proposed CaC framework would be necessary during the implementation stage to ensure that it remains aligned with evolving technologies, economic shifts, and emerging best practices.

It will also be necessary to foster strong public-private partnerships between government, industry, and research institutions to accelerate innovation and streamline the adoption of more advanced low-carbon technologies. Finally, active international engagement with global climate forums provides a platform for Qatar to share its experiences, learn from others, and influence international standards in ways that directly benefit its own transition and macroeconomic strategies. By embracing these strategies, Qatar can solidify its position as a model for other hydrocarbon-dependent economies seeking to forge a sustainable and growth-oriented low-carbon future.

Endnotes

1 Hannah Ritchie and Max Roser, “Qatar: CO2 Country Profile,” Our World in Data, 2020, accessed March 3, 2025, https://ourworldindata.org/co2/country/qatar.

2 Hannah Ritchie, Max Roser and Pablo Rosado, “CO₂ and Greenhouse Gas Emissions,” Our World in Data, 2020, accessed March 3, 2025, https://ourworldindata.org/co2-and-greenhouse-gas-emissions.

3 Hannah Ritchie and Max Roser, “Qatar: CO2 Country Profile.”

4 Sanaullah Ataullah, “Solar Power to Produce 30 Percent of Total Electricity by 2030,” The Peninsula, September 2, 2023, https://thepeninsulaqatar.com/article/02/09/2023/solar-power-to-produce-30-of-total-electricity-by-2030.

5 “Minister of Environment: Qatar Launched Many Projects and Initiatives to Minimize Impact of Climate Change,” Qatar News Agency, December 12, 2023, https://qna.org.qa/en/news/news-details?id=0033-minister-of-environment-qatar-launched-many-projects-and-initiatives-to-minimize-impact-of-climate-change&date=12/12/2023.

6 Simone Foxman, “Qatar Criticizes Nations for Making Vague Net-Zero Pledges,” Bloomberg, October 11, 2021, https://www.bloomberg.com/news/articles/2021-10-11/qatar-criticizes-nations-making-net-zero-pledges-without-a-plan.

7 “Qatar Science and Technology Park,” Accessed December 5, 2024. https://qstp.org.qa/.

8 Oluwasegun Cornelious Omobolanle and Sunday Ikiensikimama, “Gas Flaring: Technicalities, Challenges, and the Economic Potentials,” Environmental Science and Pollution Research 31, (June 2024), https://doi.org/10.1007/s11356-024-33784-y.

9 Hannah Ritchie and Max Roser, “Qatar: CO2 Country Profile.”

10 “Qatar Joins World Bank’s Global Gas Flaring Reduction Partnership,” Press release, Sustainable Development Goals Knowledge Hub, January 27, 2009, https://sdg.iisd.org/news/qatar-joins-world-banks-global-gas-flaring-reduction-partnership/.

11 “QP Joins WB in Global Fight Against Routine Flaring,” Gulf Times, March 17, 2021, https://www.gulf-times.com/story/686881/QP-joins-WB-in-global-fight-against-routine-flaring.

12 “QP Joins WB in Global Fight Against Routine Flaring.”

13 Hannah Ritchie and Max Roser, “Qatar: CO2 Country Profile;” Matthew W. Jones, Glen P. Peters, Thomas Gasser, Robbie M. Andrew, Clemens Schwingshackl, Johannes Gütschow, Richard A. Houghton, Pierre Friedlingstein, Julia Pongratz and Corinne Le Quéré, “National contributions to climate change due to historical emissions of carbon dioxide, methane, and nitrous oxide since 1850,”Sci Data 10, 155 (2023), https://doi.org/10.1038/s41597-023-02041-1.

14 Salman Zafar, “CDM Projects in MENA Region,” EcoMENA, July 27, 2023, https://www.ecomena.org/cdm-projects-mena/; “Clean Development Mechanism – Grim Future (COP18 Analysis),” Cabron Market Watch December 21, 2012, https://carbonmarketwatch.org/2012/12/21/clean-development-mechanism-grim-future-cop18-analysis/.

15 “Jetty Boil-off Gas Recovery (JBOG) Project,” Offshore Technology, May 6, 2015, https://www.offshore-technology.com/projects/jetty-boil-off-gas-recovery-jbog-project/.

16 “Carbon Dioxide Recovery (CDR) Plant,” Qatar Fuel Additives Company Limited (QAFAC), accessed February 12, 2025, https://qafac.com.qa/carbon-recovery-plant/1000.

17 “Kahramaa Reduces 8.5 M Tonnes of Carbon Emissions,” The Peninsula, November 1, 2017, https://thepeninsulaqatar.com/article/01/11/2017/Kahramaa-reduces-8.5m-tonnes-of-carbon-emissions.

18 Elias Al Helou, “Qatar’s Energy Efficiency Program Saved $1.1bn in 2021,” Middle East Economy, July 4, 2022, https://economymiddleeast.com/news/qatars-energy-efficiency-program-saved-1-1-bn-in-2021/.

19 “Qatar’s Energy Efficiency Program Saved $1.1bn in 2021.”

20 Qatar General Secretariat for Development Planning, Qatar National Development Strategy 2011–2016: Summary of Programmes, (Doha, Qatar: National Planning Council, 2011), 224, https://www.npc.qa/en/planning/Documents/nds1/NDS_EN_0.pdf.

21 “Law No. 4 of 1981 on the Establishment of the Standing Committee for Environmental Protection,” Al Meezan, accessed February 12, 2025, https://www.almeezan.qa/LawPage.aspx?id=323&language=en.

22 “Law No. 30 of 2002 Promulgating the Law of the Environment Protection,”, Al Meezan, accessed February 12, 2025, https://www.almeezan.qa/LawPage.aspx?id=4114&language=en.

23 Sayeed Mohammed, Qatar’s National Emission Inventory Report: Emission Inventories 1995-2015, (Doha, Qatar: Qatar Environment and Energy Research Institute, Qatar Foundation/Hamad Bin Khalifa University 2016), https://www.researchgate.net/profile/Sayeed-Mohammed-3/publication/323545226_Qatar’s_National_Emission_Inventory_Report/links/5a9b7efd45851586a2ac375b/Qatars-National-Emission-Inventory-Report.pdf.

24 Damilola S. Olawuyi and Elena I. Athwal, “Law and Governance Innovations on Sustainability in Qatar: Current Approaches and Future Directions,” in Sustainable Qatar: Social, Political and Environmental Perspectives, eds. Logan Cochrane, and Reem Al-Hababi (Singapore: Springer, 2023), 37-54, https://doi.org/10.1007/978-981-19-7398-7_3.

25 Sayeed Mohammed, Qatar’s National Emission Inventory Report.

26 Babak Mohammadzadeh, “Status and Foreign Policy Change in Small States: Qatar’s Emergence in Perspective.” The International Spectator 52, no. 2 (2017): 19–36, https://doi.org/10.1080/03932729.2017.1298886.