Hydrogen as a Catalyst for Emissions Reduction in Qatar

February 2025

Introduction

The world faces a major challenge in the quest to combat climate change: bridging the gap between its current reliance on fossil fuels and the reductions in greenhouse gas (GHG) emissions needed to limit global warming to 1.5-2.0°C above pre-industrial levels. To achieve this, a profound transformation is required, one that would reduce fossil fuel emissions while rapidly increasing the use of cleaner energy sources.

Among the more promising clean energy solutions is hydrogen, which could play a pivotal role in decarbonizing hard-to-tackle sectors, including transportation (particularly shipping and aviation) and industry (e.g., steel and chemicals). In a scenario where net-zero emissions targets are met by 2050, hydrogen would have to contribute up to 20% of the total emissions cuts needed and meet 22% of global energy demand.1 However, achieving such a target would necessitate a sixfold increase in hydrogen production from current levels.2

Currently, hydrogen production is heavily reliant on hydrocarbons, leading to approximately 830 million tons of CO2 emissions annually.3 Clean hydrogen accounts for only 1 percent of global hydrogen supply.4 However, there is strong global momentum towards producing clean hydrogen, with over 520 projects announced in 2021 and 39 countries adopting clean hydrogen strategies.5 By 2050, major markets for hydrogen are expected to include China, Europe, and North America, collectively accounting for about 60 percent of global demand.6 The outlook for the global hydrogen market presents a unique opportunity for Qatar to build on its current leadership in the natural gas sector and to establish dominant role in hydrogen production as well.

Opportunities for Hydrogen in Qatar

As one of the world’s top producers and exporter of natural gas, Qatar has a major head start in the hydrogen sector. The country’s strategic position and abundant, low-cost natural gas resources give it a competitive advantage in blue hydrogen production.7

In addition, its access to abundant solar energy could support the transition to green hydrogen.8 The Al Kharsaah Solar Photovoltaic (PV) project, Qatar’s first large-scale solar initiative, along with additional planned solar facilities, could allow for large-scale green hydrogen and ammonia production.

Qatar’s exports of liquefied natural gas (LNG) predominantly flow to Asia, accounting for about 80 percent of total exports. Top importers South Korea, India, China, and Japan are all ramping up policies and initiatives to enhance domestic use of hydrogen. Under its Hydrogen Economy Roadmap 2040, announced in 2019, Korea plans to produce 6.2 million fuel cell electric vehicles and roll out at least 1,200 refilling stations by 2040.9 Similarly, India has announced a National Green Hydrogen Mission, partly to increase the production and export of hydrogen but also to ramp up domestic consumption as part of national decarbonization plans.10 In 2022, China revealed its first medium- and long-term Hydrogen Industry Development Plan (2021-2035), which aims to put 50,000 hydrogen fuel cell vehicles on the road by 2025 and to scale up the use of clean hydrogen in other sectors: energy storage, electricity generation and industry.11 China is already the world’s largest producer and consumer of hydrogen.12 In 2017, Japan was one of the first countries to formulate a national strategy for hydrogen, aiming to ramp up use of the fuel in the transport and household sectors, and established a 2-trillion-yen ($12.9-billion) Green Innovation Fund to incentivize development of hydrogen-related technologies, among others.13 As global hydrogen demand grows, Qatar is positioned to capitalize on its existing relationships in the LNG market while forging new ones with hydrogen customers. Qatar enjoys the unique advantage that most of its current export destinations are also poised to be centers for hydrogen demand in the future. Moreover, its existing natural gas infrastructure could easily be repurposed for hydrogen storage and export.

Challenges to Qatar’s Hydrogen Sector

Despite its potential, the hydrogen sector worldwide faces several challenges, including high costs, safety concerns, infrastructure needs (for production, storage, transmission, and export), slow deployment of carbon capture, utilization, and storage (CCUS) technologies, limited demand for clean hydrogen, and the need for globally accepted standards.14

The gap in production costs between unclean “grey” hydrogen ($0.8-$2.0 per kilogram), blue hydrogen ($1.64-$3.09/kg) and green hydrogen ($3.0-$7.5/kg) remains a major barrier to clean hydrogen worldwide and explains its limited adoption globally.15 Regional hydrogen producers such as Saudi Aramco have noted this challenge: “It is very difficult to identify any agreement in Europe [for blue hydrogen]…and they explained it’s because of the high cost,” said Amin Nasser, Saudi Aramco’s Chief Executive.16

Clean hydrogen is not currently traded as a commodity. The industry’s high costs for production, storage, transmission, and export have discouraged many potential importers from committing to long-term investments in infrastructure, or to long-term purchase contracts.

Safety concerns also deter investment in the industry. The natural gas used for blue hydrogen production requires careful handling; explosions have already occurred in Austria, Germany, and elsewhere during blue hydrogen production. Such headaches will continue to make investors reluctant until safety measures are sufficiently improved and confidence grows in the safety of hydrogen as a fuel source.

Another factor is the need to scale up other low-carbon technologies, such as carbon capture, utilization and storage (CCUS), to limit the greenhouse gas emissions associated with the production of blue hydrogen. According to the International Energy Agency, the installed capacity of captured CO2 should increase from current levels of 45 Mt CO2 per year to 1.2 GtCO2 per year by 2030, and up to 7.6 GtCO2 by 2050.[i] Few of the CCUS projects currently in operation are dedicated to blue hydrogen production. The slow adoption of CCUS is due to uncertainties around the viability of the technology. These include the high upfront and operational costs, limited revenue streams to compensate for them, and the lack of a standardized price of carbon. This makes the revenue stream from such projects unpredictable. There is also the risk of CO2 leakages, which would affect public perceptions and stakeholder acceptance of the viability of CCUS projects.18

Additionally, Qatar should be wary of its neighbors, who have made significant strides in hydrogen production, positioning themselves ahead of the game in the emerging regional competition for hydrogen dominance. Countries like Oman, Saudi Arabia and the UAE are already implementing ambitious plans to develop their hydrogen sectors.

Additionally, despite Qatar’s leadership in the LNG market, it has continued to face logistical challenges in transporting both LNG and hydrogen due to its reliance on the Strait of Hormuz, a major maritime chokepoint. Therefore, interruptions to the flow of maritime traffic through the Strait of Hormuz present a critical national security threat.19 Furthermore, like Oman, Qatar is not part of the India-Middle East-Europe Economic Corridor (IMEC), a US-backed trade route aimed at fostering economic connectivity between India, the Gulf and Europe. A proposed pipeline to transport hydrogen from India via the Middle East, notably Saudi Arabia and the UAE, could further impact the geopolitical landscape around energy and Qatar’s strategy for dealing with it. That said, Doha has an opportunity to collaborate with Muscat, using Oman’s Suhar or Duqum Port as an alternative export hub. This could help Qatar bypass the geopolitical vulnerabilities associated with the Strait of Hormuz, ensuring more secure export routes while strengthening regional ties.

In the long term, as green hydrogen production and export ramps up and gradually replaces blue hydrogen, Qatar should capitalize on its renewable energy potential (especially solar) and build up the capacity needed to produce green hydrogen. However, like other small states, due to land constraints, Qatar will face challenges in producing renewable energy at the scale necessary to produce green hydrogen in large quantities. Furthermore, given its heavy reliance on desalination, accessing the water needed for hydrogen production is another challenge. The production of one kilogram of green hydrogen requires around nine liters of freshwater. Blue hydrogen requires even more: 12-19 l/kg. Expanding the hydrogen industry to a large scale would thus require a parallel expansion of desalination plants, which need large amounts of power—currently generated largely by oil or gas. This raises questions about how feasible “green” hydrogen production would actually be.

A Hydrogen Policy Roadmap

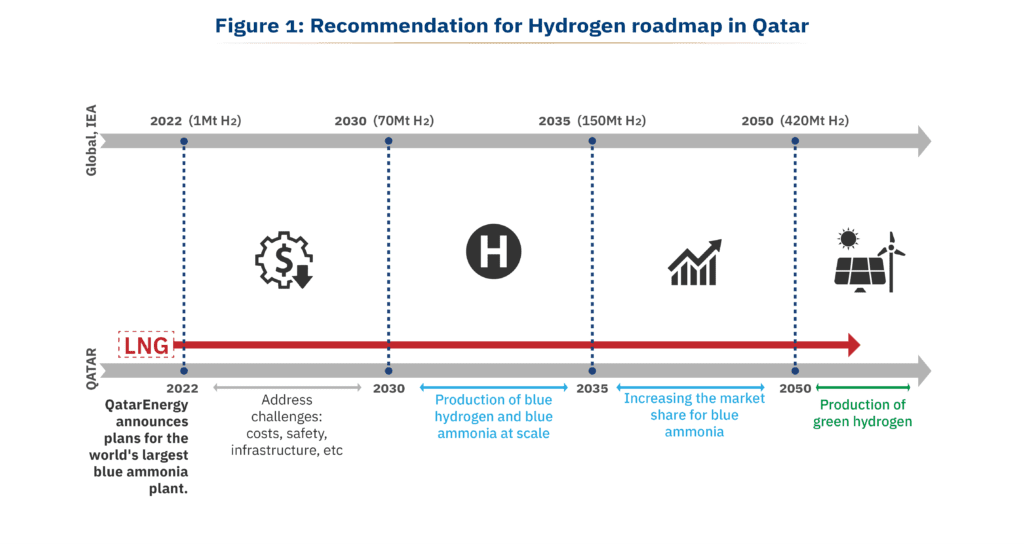

Figure 1 Recommendation for Hydrogen roadmap in Qatar. Source: Author.

Given the opportunities and challenges discussed above, Qatar appears strategically positioned to become a competitive global player in hydrogen production, thanks to its prominent role in the Asian natural gas market and Asia’s push to adopt hydrogen as a fuel source. Figure 1 outlines a roadmap with a timeframe for initiatives that would effectively ramp up Qatar’s blue and green hydrogen production.

In the immediate term, given the ongoing challenges facing hydrogen production globally, it makes sense for Qatar to wait for the hydrogen market to become more mature, allowing for key challenges such as those related with cost, infrastructure and safety to be minimized and global demand for clean hydrogen to ramp up. Assuming that the world can address these challenges and that hydrogen becomes a traded commodity by 2030, a key step in the interim would be to develop a national hydrogen strategy to build the institutional capacity needed to administer production, domestic use and export by that date.

Given the abundance of natural gas in Qatar, the production of blue hydrogen and blue ammonia—another valuable chemical, produced by combining nitrogen from the air with blue hydrogen from natural gas—would be a reasonable strategy for Qatar in the mid-term. But for Doha to develop its hydrogen sector effectively, it needs to simultaneously scale up the installation of CCUS technology to mitigate the greenhouse emissions associated with blue hydrogen or blue ammonia production from natural gas. Creating the incentives and regulatory framework necessary for scaling CCUS technologies will be crucial in overcoming challenges related to costs and emissions. In 2022, state-owned firm QatarEnergy announced plans for the world’s largest blue ammonia plant. This is a step in the right direction. Compared to blue hydrogen, ammonia is easily transported, and can be used for multiple purposes such as fertilizer production or power generation. Producing and exporting blue hydrogen is viable for Qatar given the abundance of natural gas, which can enhance the country’s competitive advantage for another 150 years.

As it grows its hydrogen national capacities, Qatar can leverage existing natural gas partnerships for long-term hydrogen collaborations. For example, it could offer to support its current natural gas customers in Asia as they transition to hydrogen, by negotiating future hydrogen export agreements. Qatar should also begin to take steps towards reconfiguring its existing infrastructure for hydrogen production, use and export.

In the long term, Qatar could capitalize on its solar energy potential and build up the capacity needed to produce green hydrogen. Given the challenges facing green hydrogen production today, especially high production costs and low demand, it may need until 2050 to start producing green hydrogen. However, it is important to note that unlike with its blue hydrogen potential, Qatar cannot build a competitive advantage by relying solely on green hydrogen production.

Finally, given the uncertainties around hydrogen production and market for it, it is important to note that Qatar will continue to lean heavily on LNG exports until hydrogen becomes a viable alternative source for natural gas.

Hydrogen presents a promising avenue for Qatar to join global efforts to reduce carbon emissions and address the climate crisis. It also presents a unique economic tool for Qatar to retain its global energy leadership by transforming itself from a natural gas exporter into a hydrogen exporter. However, a concerted effort will be needed from policymakers, industry players, and researchers if the country is to realize its full potential.