LNG Giant and Solar Dreams: Qatar’s Next Energy Chapter

January 2025

Introduction

Qatar’s owes its meteoric economic ascent to the exploitation of the North Field, the world’s largest natural gas field, which has positioned the nation as a leading exporter of LNG. In the tumultuous energy landscape of the early 2020s, amplified by the geopolitical disruptions following Russia’s invasion of Ukraine and other regional flareups, Qatar’s gas export revenues surged to $132 billion.1 The significant revenue from natural gas has been instrumental in bolstering Qatar’s sovereign wealth fund, the Qatar Investment Authority, to a valuation estimated to be $450 billion in 2023.2 The fund’s growth has catalyzed the diversification of the national economy, as per its global investments, augmented the growth of the private sector, and expanded Doha’s influence on the global diplomatic stage. The next stage in Qatar’s economic development will rely on expanding LNG exports to ensure fiscal stability while simultaneously investing in renewables as a long-term sustainable alternative.

Qatar’s LNG Expansion to Fuel the Global Transition

Qatar is rapidly expanding its annual LNG production capacity from 77 million (metric) tones (MT) in 2024 to 142 MT by 2030—an 85 percent increase.3 This growth is designed to establish Qatar as a leading player in the global LNG market, with the potential to control nearly 25 percent of the market by the decade’s end. By outpacing competitors like the US and Australia, Qatar aims to strengthen its leadership and maintain a dominant role in the global LNG industry.

The anticipated surge in LNG production and exports is expected to remain a key driver of economic development in Qatar in the coming years. Alongside its LNG expansion, Qatar has strategically positioned itself within global climate change negotiations. Transitioning from its relatively quietist stance in the 2000s, it has consistently advocated for the increased use of natural gas as a low carbon transition fuel within a diversified energy mix.

Qatar has also committed to reducing its domestic reliance on hydrocarbons, but this goal must be viewed in context. Unlike Saudi Arabia and the UAE, which faced significant gas allocation challenges in the late 2000s and early 2010s due to demand-production imbalances, Qatar has consistently managed to meet both domestic needs and export demands through its robust natural gas production.4 This favorable position is primarily due to its relatively small population size (approximately 2.7 million) and limited domestic consumption, ensuring that export capabilities remain unaffected. Additionally, compared to major oil producers in the Gulf (Saudi Arabia, the UAE, and Kuwait), Qatar’s daily oil export levels (around 670,000 barrels) are significantly lower.

Qatar’s strategic emphasis on liquefied natural gas (LNG) exports, rather than large-scale oil exports, has provided a degree of insulation from the geopolitical tensions that are frequently present in the global oil market. In addition to this protection from geopolitical instability, Qatar has been progressively adjusting its contractual pricing framework to reflect broader shifts within the LNG market. This includes greater reliance on natural gas hub pricing and increased participation in the spot market, thereby enhancing the resilience of its foreign revenue streams against fluctuations in global oil prices.5 However, as countries increasingly rely on natural gas for power generation, and the LNG market begins to resemble the international oil market, global LNG trade is projected to become more geopolitically complex. While it is unlikely LNG will be subjected to the same level of geopolitical volatility as oil, the potential for increased tensions, supply disruptions, and strategic competition is undeniable.

Introducing Renewables into Qatar’s Energy Mix: A Strategic Advantage

Initiated in 2005, Qatar’s exploration of the role that renewable energy plays in the national energy mix transcends climate concerns. Like other Gulf countries, this strategic embrace of renewables is driven by several objectives, such as Qatar’s aspirations to become a leading hub of technological innovation, fostering domestic expertise, and potentially capturing a competitive edge in the global clean energy market. Additionally, by actively integrating renewables, Qatar seeks to enhance its international standing as a responsible actor in climate change mitigation efforts.

This pursuit of renewable energy serves to counter potential criticism associated with its reliance on hydrocarbon extraction. Furthermore, integrating renewable energy sources into Qatar’s energy mix extends the lifespan of its natural gas reserves. While the scale of domestic demand reduction achievable through renewables may be proportionally small compared to Qatar’s vast gas resources, this approach enables a more sustainable management of this finite resource. Reducing domestic reliance on natural gas allows for a more measured depletion, maximizing its economic value over time.6 Lastly, Qatar, like its Gulf neighbors, possesses a wealth of natural resources that positions it for substantial success in the renewable energy sector. With an average of 9.5 hours of sunlight daily, minimal cloud cover, and extensive land availability, Qatar boasts exceptional conditions for solar energy generation. These inherent advantages provide a potent foundation for accelerating the development of its solar energy industry.7

While Qatar’s foray into renewable energy began in the early 2000s, a critical distinction exists between initial conceptual exploration, economic feasibility, public pronouncements, and concrete policy implementation. A past tendency to initiate numerous studies and research projects has not always translated into substantial policy frameworks capable of driving a significant shift away from fossil fuels. However, Qatar’s ongoing exploration of renewables and certain investments, despite potential implementation limitations, suggests a growing awareness and interest, if not yet a fully crystallized commitment, to diversify its energy mix beyond its historical dependence on hydrocarbons. This tentative embrace of renewables aligns with a broader trend within the GCC, where oil-producing states are increasingly acknowledging the long-term economic and geopolitical advantages of a more diversified energy portfolio.

Qatar’s Approach to Renewable Energy: From Cautious Embrace to Strategic Imperative

Qatar’s National Vision 2030, released in 2008, acknowledged environmental concerns and the potential of renewable energy.8 However, initial targets and policies were cautious. Since then, Qatar’s approach has become more refined, reflecting a growing recognition of the need for diversification and decarbonization. This shift began with the inaugural 2010 National Development Strategy (2011-2016), which promoted renewables’ potential for economic growth.9 This suggests Qatar’s evolving strategy prioritizes both environmental and economic c0-benefits.

However, this recognition was coupled with an underlying assumption: renewable energy technologies needed to become more cost-effective to warrant large-scale adoption. This focus on affordability led to the formation of the National Renewable Energy Committee, tasked with developing a national plan contingent upon technological advancements that would drive down costs. The move toward a more proactive approach emerged with the launch of the second National Development Strategy (2018-2022) in 2018, which more explicitly recognized the critical importance of renewable energy for Qatar’s future. This document validated the substantial potential for renewable energy generation while also realistically appraising the limited progress achieved to that point.

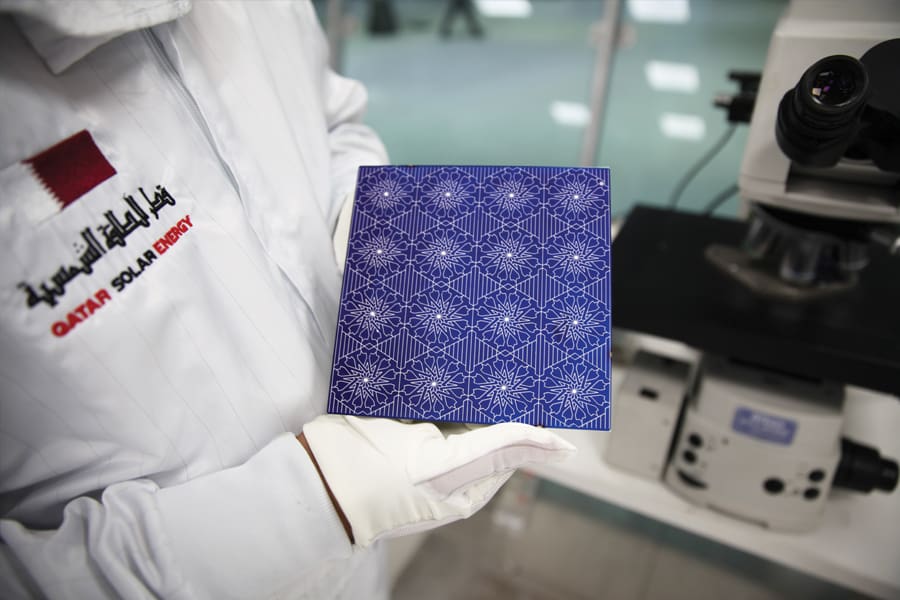

Qatar’s renewable energy efforts took a leap forward with the 800 MW Al Kharsaah solar plant, meeting 7% of peak demand by 2023 and projected to reduce emissions by 26 MT over its lifetime. This key project, launched in 2022, marks a significant step towards the Paris Agreement goals. Qatar is also expanding its solar portfolio with massive projects like the 875 MW Industrial Cities project and the upcoming 2 GW Dukhan plant. By 2030, QatarEnergy’s solar capacity is projected to reach 4 GW, contributing nearly 30% of the nation’s power generation.10

While natural gas is currently positioned as a less carbon-intensive transitional fuel compared to coal and oil, evolving climate discourse places it under increasing scrutiny. As the global transition towards renewable energy accelerates, Qatar’s substantial investments in natural gas face the potential risk of becoming “stranded assets.” This potential economic loss could occur if future tightening carbon regulations render these investments unviable. International climate negotiations have demonstrated a pattern of progressively targeting specific emission sources: first coal, then oil, and while natural gas currently enjoys an interim surge, it is likely to become a focus of contention in the mid to long-term.

One significant near-term risk is the introduction of EU regulations in August 2024 designed to reduce the methane intensity of both domestically produced and imported oil and natural gas. These regulations require LNG suppliers to submit methane performance profiles.11 Additionally, the EU has expanded its Emission Trading Scheme (ETS) to include shipping, subjecting a carbon tax on LNG cargoes entering Europe.12 In the past, Qatar has strengthened its “security of demand” by securing long-term bilateral contracts with customers across various regions. The new EU regulations, which other may eventually be emulated in other jurisdictions, is both a risk and an opportunity for Qatar to differentiate itself from other emerging LNG producers. For example, U.S. LNG producers are often associated with carbon-intensive LNG projects.13 In this context, Qatar can leverage its position by quickly aligning its LNG production to meet, and even exceed, the EU’s stringent methane and carbon intensity regulations.

Qatar’s commitment to decarbonizing its LNG production marks a strategically significant step in response to growing environmental concerns surrounding the lifecycle impacts of fossil fuel production. By setting ambitious targets to reduce carbon intensity in its LNG facilities by 35 percent and in upstream operations by 25 percent by 2035, Qatar aims to strengthen its competitive edge in the global LNG market. This proactive strategy positions Qatar to meet the increasing demand for cleaner energy and low-carbon LNG.

Diversifying into downstream sectors could also help mitigate this risk; however, it comes at the cost of significantly reduced profitability. This is due to increasing global production of petrochemicals and other downstream products, as other hydrocarbon-rich nations also pursue downstream-focused industrialization. The petrochemical industry is also under increasing scrutiny due to environmental and health concerns, particularly related to “forever chemicals,” endocrine disruptors, and the non-biodegradability of plastics.14 Over the next decade, the sector is likely to confront a glut and stricter regulations, which could further limit profitability. While downstream diversification offers a more stable revenue stream with reduced price volatility, it may ultimately be less profitable than direct natural gas exports due to the aforementioned factors.

Qatar’s Unique Approach to Decarbonization

Qatar’s approach to decarbonization differs from its neighbors. While they pursue national net-zero targets, Qatar focuses on specific sectors. This reflects concerns about the justifiable feasibility of rapid economic adjustments within the proposed timelines for a net-zero goal.15 Instead, Qatar targets decarbonization in select industries like the upstream segment of its massive LNG industry. This measured approach balances environmental responsibility with economic growth. While efforts to reduce gas flaring are underway, achieving broader decarbonization in this sector is challenging due to complex technological and technical economic hurdles like infrastructure needs, outdated equipment, and varying gas compositions.16 Qatar’s focus on LNG expansion and renewables has taken the priority and overshadows flaring reduction investments.

The 2021 unveiling of the Qatar National Environment and Climate Change Strategy reiterated Qatar’s sectoral decarbonization approach, outlining concrete goals such as the aforementioned 25 percent carbon intensity reduction for LNG production and upstream processes by 2030. Key to LNG decarbonization planning is the North Field expansion project, which envisions the establishment of the largest carbon capture and storage (CCS) facility in the LNG industry, situated in Ras Laffan to capture and sequester up to 11 MT of carbon annually.17 This is not a novel venture for Qatar; as it has been building on an existing practice of capturing and sequestrating 2.5 MT of carbon annually since 2015/16.18 Through these concerted, sectoral efforts, Qatar is attempting to position itself as a leader in environmental responsibility within the upstream LNG industry. However, the success of these initiatives is contingent upon effective practical implementation, continuous evaluation, and technological innovation. It remains to be seen whether Qatar’s targeted approach adequately responds to rising international pressure for rapid and comprehensive climate action, which will have long-term implications for Qatar’s global standing and its economic diversification objectives.

Qatar’s commitment to renewable energy and carbon mitigation is promising, though its full impact may take time to be realized. In the early 2020s, Qatar took a more measured approach to renewable energy adoption, distinguishing itself from the faster-paced strategies pursued by regional counterparts like Saudi Arabia and the UAE. However, this approach reflects Qatar’s careful consideration of long-term sustainability goals and its broader energy strategy. This divergence stems from a unique confluence of internal factors. Its small population, robust fiscal position, and the immense scale of its natural gas reserves all shape Qatar’s energy strategy and contribute to this disparity.

Additionally, while Qatar is often noted—sometimes unfairly—for having one of the highest per capita carbon emissions globally, largely due to its small population, it is important to recognize that its total national emissions are comparatively low. This paradox raises important questions about historical responsibility and the colonial legacy of the Global North in shaping global climate mitigation efforts. As a result, there may be a perceived lower urgency for Qatar to accelerate its transition away from a hydrocarbon-dependent economy.

Recommendations and Conclusion: Strategic Pathways for Qatar’s Energy Transition

While progress has been made, the specific direction and pace of Qatar’s renewable energy transition is still evolving. Nevertheless, developing a comprehensive policy and regulatory framework that supports the expansion of renewable energy projects, the liberalization of the power sector, the adoption of CCS technology, and multisectoral decarbonization can greatly accelerate progress toward achieving Qatar’s climate and Vision 2030 goals.

Qatar’s goals to expand renewable energy capacity and achieve decarbonization targets necessitate a comprehensive climate-centered legal and regulatory framework. While Kahramaa currently oversees electricity generation regulations, a more specialized regulatory approach will be vital to supporting this energy transition. Although Qatar’s power sector remains largely vertically integrated, the nation is gradually adopting the independent power producer (IPP) model, aligning with Vision 2030’s aims to foster innovation and attract investment. To facilitate this expansion, the regulatory framework could integrate mechanisms such as renewable energy certificates, support schemes for CCS technologies—including Public-Private Partnerships (PPPs) with sustainability-oriented financing terms for large-scale renewable energy projects—and green financing instruments such as green bonds.

While Qatar currently lacks the necessary enabling factors for the establishment of a successful national carbon market—such as a relatively small economy and limited market liquidity—the potential success metrics for a domestic market could arise in conjunction with a broader regional carbon market. As neighboring countries such as Saudi Arabia and the UAE develop their own frameworks, Qatar could link a future national carbon market into a regional framework.

All of the green-centered initiatives mentioned would drive renewable energy development, support Qatar’s alignment with international climate goals, and establish a foundation for future reforms and environmentally conscious private sector investments, in line with the country’s Vision 2030 development objectives. Importantly, given Qatar’s significant reliance on natural gas exportation, its long-term interest lies in actively promoting the viability of CCS as a key tool for mitigating potential risks associated with increasingly stringent international climate regulations. However, despite its enormous natural gas patrimony, as global decarbonization accelerates, renewable energy still offers Qatar compelling geopolitical, economic, and environmental benefits.

This enhanced framework would not only create a stable environment for investment and innovation in Qatar’s emerging renewable energy sector, supporting its macroeconomic diversification efforts, but it would also provide a strategic opportunity for Qatar to enhance its international standing and advance its geopolitical ambitions. By establishing itself as a leader in responsible climate action, Qatar can also cultivate strategic “climate partnerships” with targeted clean energy and carbon market investments in the Global South. By strategically leveraging climate-oriented South-South cooperation initiatives as a cornerstone of its foreign policy, Qatar can dramatically amplify its geopolitical influence in the rapidly approaching “post-oil world.”

Endnotes

1 Jamie Ingram, “Qatar Revenues Soar on Record LNG Prices,” MEES, February 10, 2023, https://www.mees.com/2023/2/10/economics-finance/qatar-revenues-soar-on-record-lng-prices/ecda7c80-a952-11ed-90c3-1dcd03eed829.

2 A. Narayanan and F. Lacqua, “Qatar Fund to Reposition $450 Billion Portfolio Amid Turmoil,” Bloomberg News, January 16, 2023, https://www.bloomberg.com/news/articles/2023-01-16/qatar-fund-to-reposition-450-billion-portfolio-amid-turmoil.

3 Jennifer Gnana, “QatarEnergy Boosts LNG Expansion Plans Again to 142 Million MT/Year,” S&P Global, February 25, 2024, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/022524-qatarenergy-boosts-lng-expansion-plans-again-to-142-mil-mtyear.

4 For further reading on the onset and implications of the gas allocation shortages that affected every Gulf and energy-rich MENA country, with the exception of Qatar, in the late 2000s and early 2010s, see:, Justin Dargin, “Trouble in Paradise – The Widening Gulf Gas Deficit,” Middle East Economic Survey, September 29, 2008; Raed Kombargi, Otto Waterlander, George Sarraf, and Asheesh Sastry, Gas Shortage in the GCC: How to Bridge the Gap (Booz & Co., 2010).

5 Suyash Pande et.al, “Qatar Energy’s Long-Term LNG Contracts with European Buyers Likely to Include Natural Gas Indexation,” S&P Global, October 31, 2023, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/110923-qatarenergy-sinopecs-long-term-lng-contract-likely-priced-around-127-slope-to-oil#:~:text=The%20LNG%20contracts%20between%20Qatar%20Energy%20and%20Shell%2C,contract%20will%20have%20to%20be%20delivered%20within%20China

6 Qatar’s natural gas resources, at current rates of extraction, are expected to last for approximately 200 years or longer.

7 “Climate in Doha (Qatar),” Weather & Climate, n.d., https://weather-and-climate.com/average-monthly-Rainfall-Temperature-Sunshine,doha,Qatar.

8 State of Qatar General Secretariat for Development Planning (GSDP), Qatar National Vision 2030, (Doha, Qatar: National Planning Council, July 2008), 5, https://www.npc.qa/en/qnv/pages/default.aspx.

9 Qatar Ministry of Development Planning and Statistics, Qatar National Development Strategy 2011–2016 (Doha, Qatar: National Planning Council, 2016), https://www.npc.qa/en/planning/Documents/nds1/NDS_EN_0.pdf.

10 Oliver Kleinschmidt, “QatarEnergy Set to Double Qatar’s Solar Capacity,” Energy Global, September 4, 2024, https://www.energyglobal.com/solar/05092024/qatarenergy-set-to-double-qatars-solar-capacity/; Anna Ivanova, “QatarEnergy Unveils 2 GW Solar Project,” Renewables Now, September 2, 2024, https://renewablesnow.com/news/qatarenergy-unveils-2-gw-solar-project-867697/.

11 European Commission, “New EU Methane Regulation to Reduce Harmful Emissions from Fossil Fuels in Europe and Abroad,” press release, May 27, 2024, https://energy.ec.europa.eu/news/new-eu-methane-regulation-reduce-harmful-emissions-fossil-fuels-europe-and-abroad-2024-05-27_en.

12 European Commission, “Reducing Emissions from the Shipping Sector,” Europa, https://climate.ec.europa.eu/eu-action/transport/reducing-emissions-shipping-sector_en/.

13 Ben Cahill and Hatley Post, “EU Methane Rules: Impact for Global LNG Exporters,” Center for Strategic and International Studies, May 3, 2024, https://www.csis.org/analysis/eu-methane-rules-impact-global-lng-exporters.

14 PFAS (Per- and polyfluorinated alkyl substances), also known as “Forever Chemicals,” are a group of over 10,000 highly persistent synthetic chemicals, often byproducts of the petrochemical industry, that do not occur naturally. These chemicals are extremely resistant to degradation and have been found in the blood and breast milk of humans and wildlife worldwide. PFAS are prevalent in everyday products, including food packaging, clothing, cosmetics, and toilet paper. Numerous studies have linked PFAS to a range of health issues, including cancer, high cholesterol, thyroid disease, liver damage, asthma, allergies, and reduced vaccine response in children. They are also associated with decreased fertility, low birth weight, birth defects, and developmental delays in newborns. Additionally, endocrine disruptors (EDCs), which include synthetic compounds and heavy metals, can interfere with hormone function and increase the risk of cancer, cardiovascular disease, infertility, and other health problems. See, Program on Reproductive Health and the Environment, “Petrochemical Proliferation Contributing to Rise in Health Problems,” March 6, 2024; Harvard T.H. Chan School of Public Health, “Protecting Against ‘Forever Chemicals,’” March 16, 2023.

15 A. Mills and T. Hepher, “Qatar Airways CEO Suggests 2050 Net-Zero Goal Beyond Reach,” Reuters, May 23, 2023, https://www.reuters.com/business/aerospace-defense/qatar-airways-ceo-doubts-2050-net-zero-goal-can-be-reached-2023-05-23/.

16 Qatar initiated its gas flaring mitigation program in 2012, achieving some progress, though challenges remain. A substantial portion of the flared gas is associated gas, which requires significant infrastructure investments—such as pipelines, processing facilities, and reinjection capabilities—to capture and utilize. Some existing facilities in Qatar use outdated equipment, making gas capture and processing difficult and costly to upgrade. Furthermore, the varying composition of associated gas demands adaptable processing technologies, while high operational costs impact the economic feasibility of reduction projects. Additionally, Qatar’s focus on expanding LNG export capacity and renewable energy has often sidelined investments in flaring reduction. For more information about Qatar’s flaring reductions initiatives and progress, please see, World Bank Group, Qatar’s Journey to End Routine Gas Flaring, Global Flaring and Methane Reduction Partnership (GFMR) Brief, n.d.; Mohsin Raja, et al, Qatargas Flare Reduction Program, in Advances in Gas Processing: Proceedings of the 4th International Gas Processing Symposium, ed. Mohammed J. Al-Marri and Fadwa T. Eljack (Elsevier, 2015), 261-271.

17 “GE Helps QatarEnergy Develop a Carbon Capture Hub at Ras Laffan,” Gas to Power Journal, October 3, 2022, https://www.gastopowerjournal.com/markets/item/13020-ge-helps-qatarenergy-develop-a-carbon-capture-hub-at-ras-laffan.

18 Santhosh V. Perumal, “Qatar plans to capture up to 11mn tonnes of carbon per annum,” Gulf Times, June 21, 2022, https://www.gulf-times.com/story/719637/Qatar-plans-to-capture-up-to-11mn-tonnes-of-carbon-per-annum.